Last Updated on October 5, 2020 by NandiNN

How to Make An Extra 500 a month

How would you feel if you could make $500 a month? Or what would an extra $1000 month do for you or your family?

If you are looking for ways to make extra money this month, we can give you a few tips to get started.

Personally, I like to come up with a few creative ways to make money for my family each month as it lifts any financial stress from me.

If I can make an extra $500 this month, and maybe $600 the next month, this is all extra money that I can use to pay off debt faster or add to my savings account.

Either way, making extra money from home is always the ideal situation for me.

Finding a part-time job is also an okay route to choose if you are looking for extra ways to make extra money, but with a baby and the job economy, this might not always be the ideal situation for everyone.

Today, we really wanted to focus on easy ways to make $500 a month online! It is very possible, as long as you have the right tips and direction to go by.

How Can I make $500 Fast Per Month?

Sometimes life can throw us some crazy curve balls and the only way to get out of it is to make that extra cash!

Emergencies do happen, unexpected expenses tend to pop up when least expected and life can sometimes get the best of us!

If you do not have that emergency binder and fund that we talked about or you just need that extra $500 a month to get through a huddle, our tips today should get you by!

All you need to do is to be dedicated and work hard.

So how can you make an extra 500 a month?

Before we get started on how you can make $500 a month, we did want you to follow us on Facebook for more awesome ideas on saving or making more money. You can also follow us on Instagram for more tips.

We also wanted to take the opportunity to let you know that we use Affiliate links on some of our blog posts. This means that we could make a commission if you click on an affiliate link and purchase something. Please check out our full disclaimer and policy page here.

Ways to Make $500 A Month Online or From Home

For many people, the hardest thing about making money from home is finding the right thing to do.

It can be difficult, at first, to figure out how to make money and pursue realistic financial goals.

This guide is here to help you develop those money-making habits to get you started right away and start adding extra money to your savings account each and every month or to help out where you need it the most.

With these tips, you can start to make $500 a month and then the next step is learning how to make an extra $1000 a month from home and keep growing from there.

Are you ready to make some extra money?

Related Posts:

Tips that the frugal don’t share about saving money

10 Epic Money Saving Blogs for Frugal People

Simple Steps For Earning Extra Money

The first step to learning how to make $500 a month or even how to save money each month is to figure out exactly how much you spend each month, and this means tracking your many expenses.

This could mean simply looking at your bank statement to see your debit or credit card purchases, but make sure to also include gas, groceries, and coffee habits, along with mortgages, and other large amounts.

Then from here you can make a budget and work to organize your expenses into that budget.

It should outline your expenses, your income, and your future goals.

Overspending is a real reality without a budget, so it’s best to really examine your budget, especially when considering those things that don’t occur each month, like seasonal bills.

You can find a list of amazing FREE Monthly Budget Template Printables to start your budgeting.

Once you better understand where you stand financially, you can then start to make a plan to make $500 a month if your budget desperately needs this.

Schedule Automatic Savings to Make $500 this month

Ensure that your household budget is completely accurate before going to this next step.

Once you’ve developed your budget and you have a better grip on your spending habits, it’s time to automate your savings account.

If your income automatically goes into your savings account, there’s no way to spend it before you manually put it into your savings.

This can happen by automating a direct deposit from your employer or setting up your checking account to do send money to your savings account on payday.

This is a great feature especially if you want to save money each month

You can also grab our no spend planner to help manage your current expenses. Who knows? This might just add up to an extra $500 a month for you.

Make An Extra $500 Per Month

If you’ve taken some time to calculate your budget and an extra $500 doesn’t look like it’s in the cards, and you can’t cut back on any other expenses like subscription services, then it’s time to consider making some extra money each month.

It is a great idea to add some extra income in order to help you save money each month.

This will also allow you to live more comfortably and stop you from going into debt or even more debt if you are already heading that direction.

That’s why this post is perfect for people looking for ways to make an extra $500 per month.

What should you do with the extra 500 per month you make?

When I get a lot of questions like these, how can I make an extra $500 a month? It sometimes makes me wonder.

First, why you need that extra cash.

Personally I would:

- Per off debt

- Start an emergency fund using these tips

- Pay off my car and house

- Put extra money in my daughter’s fund

But whatever your reason for wanting that extra cash, we hope these tips help you.

Related:

Brilliant Hacks on Becoming Debt Free without filing for bankruptcy

17 Simple Business Ideas For Women To Make Extra Cash

How to Make $500 a Month:

1. Become a Freelance Writer

Make an extra 500 a month by becoming a freelance writer. Start as simple as creating a profile on one of the online freelance websites like up work or Fiverr.

Anyone interested in making money as a writer, graphic designer, accountant, translator, programmer, developer, salesperson, marketer, or virtual assistant can do so online.

If you are ready to get paid to blog and write articles from home, then is absolutely something you should consider to make extra money.

There are always over 100,000 jobs listed on up work or Fiverr.

If you wanted to be a freelance writer, for example, you can create a profile for free and then start looking for jobs.

It’s actually possible to find writing jobs that pay around $30 an hour, which means an extra four hours of work each week could be another $500 in your account.

This is an amazing way to make $500 a month!

But what if you are not sure what to write about?

Then you, my friend, are in luck!

Be sure to grab this freebie list of over 200 niches that accept freelance writers.

What you will need to become a freelance writer and make an extra 500 a month:

- A niche you want to write about

- A portfolio

- A list of potential clients

- An Income tracker like this one

- Internet & a computer

- Determination

| Read to make an extra 500 a month as a Freelance Writer? Start by enrolling in a freelance writing course run by someone who has been successful as a freelance writer |

Related:

Sure-Fire Ways to Finding Freelance Writing Gigs that Pay Well

10 Tips to Kickstart your Freelance Writing Career off the ground

2. Start a Baby Equipment Rental Business

If you are a stay at home mom, this side business exactly what you should look into starting!

You can start your own Baby Equipment rental business and start earning as much as an extra $600 per month!

BabyQuip provides the infrastructure and platform for you to build a successful baby equipment rental business.

BabyQuip Independent Quality Providers work from home and run their own business renting baby equipment to traveling families, grandparents hosting grand-kids, families relocating, and more!

You can find out more about how to start your Baby Equipment Rental business right here!

This is a growing career that you should definitely look into starting.

3. Become a Freelance with Stella and Dot

I was able to make a good $400 on just one weekend as a Stella and Dot Associate!

I definitely went on to make much more money after that but as you can see, you can definitely make money with them.

For those wondering how to make $500 a month, this is for you.

If you are interested in becoming a Stella and Dot Associate, which we highly recommend, please sign up here!

If you want to read more about how I was able to make money using this easy side job, you can find it here.

4. Make $500 a Month Blog Flipping

Honestly, you can make more than $500 a month online with this amazing side hustle.

You can actually make $2,500 a month flipping blogs if you devote your energy and time to it.

So what exactly is blog flipping?

Blog flipping is buying a Blog or building a blog, then selling it (flipping it) for a profit. It works just like house flipping.

When you flip a house, you purchase a property below value or at a really great deal, then make improvements and sell it a profit.

Blog flipping works the exact same way.

Website Flippers University takes you through the website flipping journey

Ready to learn more about how to make an extra 500 a month? Consider flipping blogs!

People are flipping blogs and selling them for profits almost every month.

You definitely want to ensure your blog is valuable if you want to make at the very list $500 with it.

This means you it is set up and has at least these qualities:

- Making money – here is what I recommend you do to make money with a blog

- You have ads running – Mediavine or Adthrive as your ad agencies

- And that you are using affiliate marketing on your blogs

The Website Flippers University takes you through everything you need to set up, monetize, and flip your blog for a profit.

5. Make $500 A Month As A Pinterest Virtual Assistant

If you want to work from home and you are looking for ways to make $500 a month online using Social Media, then this is for you.

You can become a Pinterest Virtual Assistant which is an upcoming popular work from home job. A lot of people are becoming Pinterest VA because it is literally so easy to do!

If you are a beginner Pinterest VA, you can expect to charge as low as $15-$20 per hour.

As your business starts to grow and expand, your hourly rate can increase to as much as $75-$100 per hour.

You can get more information about becoming a Pinterest Virtual Assistant right here!

You have the potential of making about $4000 a month as a Pinterest VA, so I really encourage you to give it a try.

If you want to know other ways to make money on Pinterest <– read this post today!

Related:

Become a Pinterest Virtual Assistant that Actually Makes Good Money

6. Learn how to make $500 a month passively

Passive income is when you make money without actually putting in hours.

If you want to know more about amazing Passive income ideas read this blog post.

However, some of my favorite ways of making some extra passive income are typically done by participating and earning money via investment opportunities.

A great place to start with that is with Lending Club.

Lending Club makes it easy to participate in one of the best passive income opportunities online!

You are able to lend money and get a return plus 4-10% interest totally risk-free!

You would be lending out your money for other people to use and getting paid back with interest. You can lend out money as low as $25.00.

This is my favorite way of making extra money.

Try it out, especially if you are trying to make $500 a month each month!

7. Earn $500 a Month by Referring Links to Friends

How can I make an extra $500 a month with little effort?

Did you know that you could earn money by inviting friends to use services and programs that you like and are already using?

This means you are familiar with them and recommending them won’t cost you a thing.

It could only make you some extra cash each month, depending on which of your friends actually sign up for your offer.

Here are a few ways I earn money by referring links to friends:

- Referring Friends to Airbnb – Earn $25.00

- Get Paid for Referring friends to Stella and Dot

- Refer a Friend to Rover and Earn $20.00

Find more creative ways to make money on the side by referring friends in this blog post!

We listed so many great opportunities you should try today in order to make $500 a month.

Related:

Make Money While Traveling – 7 Genius Hacks to Getting Paid to Travel

13 Genius Ways To Make Money on the Side Every Month

9 High Paying Side Jobs that can become your Full-time Income

8. Earn Money by Teaching English Online

Teaching English online from home is fast becoming a popular trend due to the fact that it pays really well.

If you are looking for ways to make $500 a month online or more, then you should consider teaching English.

Most places do not require you to have a degree or even past experience which makes it the best opportunity to earn some money from home.

My most recommended place to find English teaching jobs are:

Ready to earn money by teaching English online? Tell us how it goes.

So many people have jumped the wagon and are happily teaching English online to earn extra money.

If you really want to make $500 a month to help with your finances, this might just be your gig. Read my full review about this gig right here.

9. Become A Part-time Proofreader

Are you good at picking out grammatical errors?

Do you have great attention to detail or just love to read and edit?

Then you, my friend, can become a proofreader and earn extra money from the comfort of your home.

There are a lot of online businesses and bloggers that are in the need of proofreaders so the demand is absolutely there.

As a proofreader, your job may include you reviewing different content and checking for grammatical errors, spelling, and formatting.

If you want to become a proofreader sign up for this amazing free proofreading webinar about how to build a proofreading business in just 30 days!

You can look for more proofreading jobs on sites such as Flexjobs, EditFast, Scribendi, Upwork, and many more.

You can even start your own freelance proofreading online business which will allow you to set your own rates, pick your hours, and run the business as you like.

Expect to make an extra $25-45 an hour as a proofreader.

It’s the best way to make an extra $500 per month every month.

10. Make $500 A Month Selling Printables

If there is one creative way I encourage to make extra cash, it’s by selling printables online for a profit.

I am so obsessed with making printables as I know how profitable they are.

If I can create something simple and have it make me passive income every single month, then you know I am doing it.

A good blogger friend of mine, Sarah Titus was able to make over $2 Million a year selling Printables and this only got me really curious.

Be sure to watch the video below to see exactly how a stay at home mom was able to make over $6K+ per month selling Printables!

This is why I truly believe for those looking for ways on how to make $500 fast online, should truly explore this business venture.

I learning everything I need to know about making and selling printables from Suzi!

If you really want to make 500 a month, then try out the Printable side business.

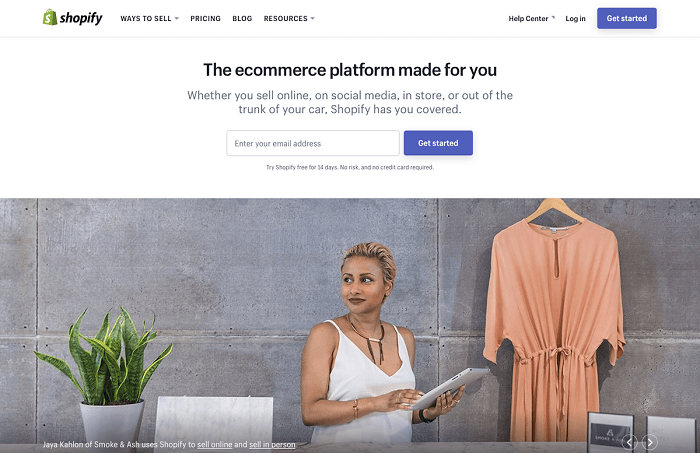

11. Start a Profitable Online Store with Shopify

We already discussed selling printables for a profit.

Why not start a store that houses your printables?

Or you can simply start a profitable online store with Shopify and sell other things.

This is the best way to make 500 a month!

As you may know, online stores have become extremely popular over the last couple of years and they seem to keep growing in popularity.

I started my own wedding store this year and it has been nothing but profitable. I am so glad I made that decision as I can now make a steady $500 extra a month with little effort.

Not sure what to sell?

Here are a few amazing ideas:

- Try selling physical products, for example, art or DIY items

- You could try drop-shipping with Shopify which is a very popular route for a lot of successful women entrepreneurs – This is when you use other people’s products to sell on your own store! Shopify has a great tool to help you with this in case this is an option for you!

- You could sell digital products which will be a big part of my store (Printables are huge sellers)

You can also find the top 13 things to sell in Shopify that make the most money!

Shopify is the platform I use and highly recommend.

They have extremely professional templates and I have done tonnes of research on them that’s why I chose them.

Plus they offer a 14- day free trial!

12. Make An Extra $500 A Month By Using Legit Survey Sites

There are a lot of scam survey sites out there!

But did you know that they are some legit survey sites you can use to get FREE cash? Yes, I have used them multiple times and they pay using PayPal!

For example, my favorite online survey is SurveyRewardz or even InboxDollars!

And if you want to get free gift cards, be sure to participate in these online Surveys that will reward you with gift cards:

These are the 4 I use frequently especially if I am trying to make extra cash.

By participating in online surveys that are legit, you have a better chance of making that extra $500 a month that you really need!

There you have it!

13. Get Paid For Your Opinion

Did you know that you can get paid for sharing your opinion?

Yes, you can!

Now can you imaging making an extra 500 a month just for sharing your honest opinion?

There are brands and businesses who care about your opinion or what you have to say and they are willing to pay you for this opinion!

One of my favorite apps for sharing my opinion is MyPoints!

With MyPoints, you can earn $5 when you take 5 surveys today.

When you sign up using the link above, you will get invited to new surveys. When you do the surveys you will earn points for giving your honest answers.

Redeem your points for gift cards from your favorite brands or cash via PayPal.

You can also use Swagbucks – you can find out how I was able to make over $500 with them easily right here!

Get paid for your opinion using our top brands!

That’s everything you need to know about how to make $500 fast!

Choosing Something to Save For

In the end, to find the motivation to cut back on the expensive coffees or work extra hours as a freelancer, it’s really important to choose something to save for.

Short-term goals may include emergency funds, down payments, or even fun things like a vacation or wedding.

What will you be saving for? Why do you need more money?

When you know your reason why you need that extra money or extra income, can better understand your priorities when it comes to saving more money each month or even making extra money on the side.

Are you ready to make $500 a month? If so, we want to hear from you. Tell us your plans in the comment section below.

You can find more money-making ideas right here. Or you can check this list too:

- Try Becoming a Pinterest Virtual Assistant

- Consider teaching English Online As a Second Language

- Start a $2500 a Month Side Business Flipping Blogs

- Start a Baby Equipment Rental Business

- Learn How to Start A Successful Virtual Assistant Business

- Start a Blog and Make Money from It

- Here is how you can get paid to Blog and Write Articles from Home

- Make $47, 000 A Year Proofreading Anywhere

- Make Money As An Online Virtual Bookkeeper

Want to make an extra $500 a month, read this next:

Don’t forget to pin this post here to your work from home job board.

If you enjoyed our blog we would like to have you join our email list and receive weekly money-making tips, you can join now! Don’t forget to like the Facebook page. The page is created to share your work, pitch your services, and learn from other experienced bloggers!

***We would like to note that this post and most posts on our blog may contain affiliate links. This means that if you purchase something that has an affiliate link, we will get a commission from it. Not all items recommended on our site are affiliate links. We only recommend items that we have used and tried. These items have brought us much success and we highly recommend them to you in order to be successful. Thank you for your trust!

Lovely content, good information in your article Many people can’t find such content these days. God, you keep uploading such articles. Talk to your Credit Correction Master today! 먹튀검증사이트

That’s a good post, please continue to share such wonderful posts! I feel better reading your post.Interesting and interesting information about this topic can be found here in your profile.You are so interesting! I don’t think I’ve really perused such a thing before. It is very special to find someone for certain consideration of this matter. Sincerely, thank you for firing this. 안전놀이터

Pug Puppies for Sale Near Me

pugs puppies for sale

teacup pugs for sale

pug puppies for sale by owner

pug puppies ohio

PUG PUPPY FOR SALE NEAR ME

PUG PUPPIES FOR SALE

pug puppies for sale in kentucky

Pug Puppies for Sale Under $500 Near Me

pug puppies for sale in texas

pug puppies for sale $200

pugs for sale near me under $500

pugs for sale under $400 near me

pugs for sale near me

puppies for sale near me under $500

pug puppies for sale under $1,000 near me

pug for sale

pug puppies for sale under $300

Brindle Pug

Pitbull Pug Mix

Pugs for sale cheap

Cheap pug

affordable pug puppies for sale near me

black pugs for sale near me

White Pugs for sale

pug dog for sale

free pug puppies

pug puppies for sale in my area

mn pug breeders

pug puppies indiana

pugs for sale michigan

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

PUG PUPPY ADOPTION

Pug puppies for sale

Pug puppies for sale near me

Pug puppies near me

Pug Puppies for Sale Under $500 Near Me

Cute Pug Puppies

Black pug puppies

Black pug puppies for sale

pug puppies for adoption

black pug puppies for sale near me

chihuahua pug mix puppies

how much is a pug puppy

teacup pug puppies

baby pug puppies

baby pug puppies for sale

pictures of pug puppies

pug puppies for sale in Ohio

pug puppies price

pug mix puppies

teacup pug puppies for sale

best food for pug puppy

newborn pug puppies

pug puppies craigslist

pug puppies for sale craigslist

adorable pug puppies

how much does a pug puppy cost

Pitbull pug mix puppies

pug pit mix puppy

pug puppies for sale $200

pug puppies for sale in NJ

Pug puppies for sale in Wisconsin

pug puppy cost

pug puppy food

royal canin pug puppy

royal canin pug puppy food

fawn pug puppy

pug puppies for sale florida

pug puppies for sale in Indiana

pug puppies for sale in KY

pug puppies for sale in NC

pug dog puppy

AKC Registered Pug Puppies For sale

cheap pug puppies for sale near me

cheap pug puppies for sale in California

cheap pug puppies for sale in nj

Black Pug Puppies for sale

pugs puppies for sale

Looking at this article, I miss the time when I didn’t wear a mask. casinocommunity Hopefully this corona will end soon. My blog is a blog that mainly posts pictures of daily life before Corona and landscapes at that time. If you want to remember that time again, please visit us.

바카라사이트

카지노사이트

카지노게임사이트

온라인카지노

퀸즈슬롯

맥스카지노

비바카지노

카지노주소

바카라추천

온라인바카라게임

안전한 바카라사이트

바카라

카지노

퀸즈슬롯 카지노

바카라게임사이트

온라인바카라

밀리언클럽카지노

안전카지노사이트

바카라사이트추천

우리카지노계열

슬롯머신777

로얄카지노사이트

크레이지슬롯

온라인블랙잭

인터넷룰렛

카지노검증사이트

안전바카라사이트

모바일바카라

바카라 필승법

메리트카지노

바카라 노하우

바카라사이트

온라인카지노

카지노사이트

카지노게임사이트

퀸즈슬롯

맥스카지노

비바카지노

카지노주소

바카라추천

온라인바카라게임

안전한 바카라사이트

바카라

카지노

퀸즈슬롯 카지노

바카라게임사이트

온라인바카라

밀리언클럽카지노

안전카지노사이트

바카라사이트추천

우리카지노계열

슬롯머신777

로얄카지노사이트

크레이지슬롯

온라인블랙잭

인터넷룰렛

카지노검증사이트

안전바카라사이트

모바일바카라

바카라 필승법

메리트카지노

바카라 노하우

https://youube.me/

https://instagrme.com/

https://youubbe.me/

https://Instagrm.me/

https://Instagrme.net/

https://internetgame.me/

https://instagrme.live/

https://naverom.me

https://facebokom.me

바카라사이트

온라인바카라

실시간바카라

퀸즈슬롯

바카라게임

카지노주소

온라인카지노

온라인카지노사이트

바카라게임사이트

실시간바카라사이트

바카라

카지노

우리카지노

더킹카지노

샌즈카지노

예스카지노

코인카지노

더나인카지노

더존카지노

카지노사이트

골드카지노

에볼루션카지노

카지노 슬롯게임

baccarat

텍사스 홀덤 포카

blackjack

바카라사이트

온라인바카라

실시간바카라

퀸즈슬롯

바카라게임

카지노주소

온라인카지노

온라인카지노사이트

바카라게임사이트

실시간바카라사이트

바카라

카지노

우리카지노

더킹카지노

샌즈카지노

예스카지노

코인카지노

더나인카지노

더존카지노

카지노사이트

골드카지노

에볼루션카지노

카지노 슬롯게임

baccarat

텍사스 홀덤 포카

blackjack

https://youube.me/

https://gamja888.com/

https://youubbe.me/

https://Instagrm.me/

https://Instagrme.net/

https://internetgame.me/

https://instagrme.live/

https://naverom.me

https://facebokom.me

카지노사이트

슬롯사이트

온라인카지노

카지노주소

카지노검증사이트

안전한카지노사이트

슬롯카지노

바카라게임

카지노추천

비바카지노

퀸즈슬롯

카지노

바카라

안전한 바카라사이트

온라인슬롯

카지노사이트

바카라

바카라사이트

파라오카지노

제왕카지노

mgm카지노

더킹카지노

코인카지노

솔레어카지노

카지노게임

마이크로게이밍

아시아게이밍

타이산게이밍

오리엔탈게임

에볼루션게임

드래곤타이거

드림게이밍

비보게이밍

카지노사이트

슬롯사이트

온라인카지노

카지노주소

카지노검증사이트

안전한카지노사이트

슬롯카지노

바카라게임

카지노추천

비바카지노

퀸즈슬롯

카지노

바카라

안전한 바카라사이트

온라인슬롯

카지노사이트

바카라

바카라사이트

파라오카지노

제왕카지노

mgm카지노

더킹카지노

코인카지노

솔레어카지노

카지노게임

마이크로게이밍

아시아게이밍

타이산게이밍

오리엔탈게임

에볼루션게임

드래곤타이거

드림게이밍

비보게이밍

https://youube.me/

https://gamja888.com/

https://instagrme.com/

https://Instagrm.me/

https://Instagrme.net/

https://internetgame.me/

https://instagrme.live/

https://naverom.me

https://facebokom.me

온라인바카라

카지노사이트

바카라사이트

인터넷카지노

바카라게임사이트

퀸즈슬롯

카지노주소

비바카지노

카지노추천

카지노게임

온라인카지노사이트

카지노

바카라

온라인카지노

카지노게임사이트

카지노검증사이트

로얄카지노계열

슬롯머신사이트

맥스카지노

바카라게임사이트

카심바코리아 카지노

모바일카지노

실시간바카라

라이브카지노

온라인슬롯

바카라 이기는방법

안전카지노사이트

우리카지노사이트

샌즈카지노주소

바카라 게임규칙

바카라 게임방법

온라인바카라

카지노사이트

바카라사이트

인터넷카지노

바카라게임사이트

퀸즈슬롯

카지노주소

비바카지노

카지노추천

카지노게임

온라인카지노사이트

카지노

바카라

온라인카지노

카지노게임사이트

카지노검증사이트

로얄카지노계열

슬롯머신사이트

맥스카지노

바카라게임사이트

카심바코리아 카지노

모바일카지노

실시간바카라

라이브카지노

온라인슬롯

바카라 이기는방법

안전카지노사이트

우리카지노사이트

샌즈카지노주소

바카라 게임규칙

바카라 게임방법

https://gamja888.com/

https://instagrme.com/

https://youubbe.me/

https://Instagrm.me/

https://Instagrme.net/

https://internetgame.me/

https://instagrme.live/

https://naverom.me

https://facebokom.me

HOW I CLEARED MY DEBT IN HOURS .

If you are in any debt and you need money to clear your debt and you need money to pay off those bills i will advise you contact DARK WEB CYBER HACKERS to get a bank transfer hack or blank atm card because I just get paid $50,00 for their service and I got my blank atm card of $90,000 delivered to my destination after 24hours of payment i trust their service and they are reliable and trustworthy don’t SEARCH no more contact them today and get paid without the fear of being ripped off your money okay

Visit their company website at

https://darkwebcycberhackers.com/

For quick and direct response email them at

Email: [email protected]

Text & Call or WhatsApp: +18033921735

Contact them and get paid.

Such a commendable blog it is. Thanks for sharing this with us.

Tractor Price

If you do end up making an extra $500 a month! We want to hear from you.

Thank you Arianna,

Anything to make an extra $500 is always helpful 🙂

A few of these can definitely be use if you are outside of the US. I am in Canada and I have used a few of these side hustles. A few examples are:

– Becoming a Pinterest Virtual Assistant is a good one

– Becoming a Virtual Assistant

– Blog Flipping can be done anywhere

– Becoming A Freelance with Stella and Dot

– Starting a Baby Equipment Rental Business

These are plenty for sure.

Wow! What? I had no idea there were so many options for making some extra cash. I need to look at this a little closer. Thanks for so many intriguing options.

very informative, but most of those jobs are only helpful to people staying in the United states, but it is not an advantage to us that are staying outside the US.

Freelance writing is a great way to make money from home. Let us know if you give it try!

What a great comprehensive list! These are amazing, fresh tips!

Thank you, I want to do freelance writing starting early January 2019, I prefer writing compared to other methods of making money online

Yes, I love freelancing jobs!

I hope my list has inspired you to make some extra money this month!

Wow, this was super helpful. I’m always looking for little ways to make extra money and I had no idea some of these things even existed. Like a Pinterest Virtual Assistant? Amazing.

Picking up extra freelance work is a great way to earn more money. Good tips!

Love these tips! Definitely going to check them out. Thanks for sharing!

Wow, great post dear! So interesting review!

Lovely photos. You have so interesting blog and I like it.

Follow for follow? Let me to know on my blog.

http://www.suslukokona.com

Such an interesting post! Definitely trying this out!

Wow, very helpful, and downloaded the planner, thanks much 🙂

These are great tips! I love having a small auto transfer amount from our checking to our savings. They happen regularly and automatically, so it’s like I don’t even see the $. It’s perfect for a just in case fund

I love these tips!