Last Updated on November 12, 2020 by NandiNN

How to Live On A Tight Budget And Save Money

Do you think living on a tight budget is something to be embarrassed about? It’s unbelievable how many people think like this.

Did you know that almost half the population in the USA are living paycheck to paycheck?

That is insane.

Trying to make ends meet on a tight budget can also be extremely stressful for a lot of households.

But it is doable.

Some people have no choice but to get on board and tighten up their budgets instead of going into debt with unnecessary credit card bills.

We are going to share with you our favorite tips on how to live on a tight budget and still save money.

Living on a tight budget is not a shameful thing, it just means that you need to be wiser about how you spend what you have.

Everyone falls on rough times once in a while.

For example, 3 and a half years ago, I had just found out that I was pregnant and my workplace at the time fired me.

I didn’t know what I would do.

Guess what guys, I went home that day, cried for a week, and then came up with an epic plan.

And instead of going out and getting a personal loan (which is not necessarily a bad thing), I was able to come up with a great and still managed my new income and lived comfortably.

That’s why you will get all our best tips for living on a tight budget.

The best way of doing this is to really sit down and re-evaluate your budget and only spend money when you have to.

I know many of you believe that living on a tight budget is totally impossible, but honestly, with the right strategies in place, you can do it.

If you have not read my other post on the tips I share about the different ways to save money on a tight budget and still make $3,000 be sure to check it out.

Living a Simple Life With Little Money

Remember living on a tight budget does not mean that you are doomed. You need to take a hard look at your personal finances and find out how you can take back control of it.

That’s basically it!

A good place to start is to really stop letting your finances control you and use this powerful financial advice for women to help you improve your finances today.

Once you know what you are dealing with, you can go ahead and create a budget and stick to it.

Your lifestyle might change a little but what won’t kill you. It will only make you stronger as an individual, a couple, or a family.

With this in mind, how can you make living on a tight budget more fun and doable?

And if you haven’t already, this is a good time to think about starting a budget!

I am going to share my best tips on how to live on a tight budget, so get ready.

Before we get started on the best ways living on a tight budget is doable, we did want you to follow us on Facebook for more awesome ideas on saving or making more money. You can also follow us on Instagram for more tips.

We also wanted to take the opportunity to let you know that we use Affiliate links on some of our blog posts. This means that we could make a commission if you click on an affiliate link and purchase something. Read our full disclosure and blog policy for more information.

What does it mean to be on a tight budget?

A tight budget could mean so many different things for a lot of different people depending on the circumstances.

In other words, my tight budget may not necessarily be your tight budget.

According to the dictionary, “A tight Budget” is: involving a relatively small amount of money for planned spending!

When I lost my job, my husband and I went from a comfortable living situation to adjust our spending.

We didn’t necessarily move houses or sell our car (although I almost lost the car).

But we adjusted what we would normally spend and went on to live on one income for a majority of the time.

Today we are going to share our best tips on how you can live on a budget that makes sense to you and your situation.

This post is perfect for those that have any of these questions:

-

How do you live comfortably on a tight budget?

-

Or, how do you survive on a low-income budget?

-

How do you pay bills on a tight budget?

If you have any of these questions or more, we are so happy that you are here.

Learn to Live on a Small Budget

I have already mentioned this, but it is best that you understand that living on a budget is extremely hard but absolutely doable.

Learning to live on an even tighter budget can be hard for those that are used to a certain lifestyle.

I mean, have you watched Schitt’s Creek?

They went from luxurious to living in a small motel room.

As long as you can create a working budget, most people can safely learn to manage the money they have to live on.

This will require you to have money management skills that you can use to manage on little money.

Most people worry about how they can get by each month especially if bills are constantly pilling up.

But if you know exactly what you need then all the unnecessary expenses can be cut off.

Living on a budget just requires you to live within your means as much as you can.

How to Live Frugally and Happy: 7 Tips to Follow

We are going to share a few tips you can follow in order to be more comfortable especially if you only have one income to go by.

When I found myself suddenly pregnant and on bed rest 3.5 years ago, I knew we had to make some financial adjustments and sacrifices.

Apart from finding ways to make money while on maternity leave, I found other ways to make sure that my spouse and I were comfortable living on a tight budget as our lives depended on it.

1. Cut Off Unnecessary Expenses

As soon as you know that you will need to live on one income, make the necessary adjustments quickly to cut off any and all unnecessary expenses.

These tips for living on one income go for anyone that may be tight on cash as well.

So go ahead and call that cable man and cut off that cable. In fact, does anyone still watch cable TV?

Do you have a house phone and even your cellphone? Do you really need the two?

I went ahead and disconnected my cell phone because I was home most of the time and I had my laptop and internet if I ever needed to look up anything.

Make the choice to get rid of one or both if you can make do.

Now go through all your utilities, re-occurring bills, and trim your expenses where necessary.

Think about everything you may pay for:

- Amazon Prime

- Netflix

- Magazine subscriptions

- Gym memberships

Remember, living on a tight budget requires you to make hard choices and sacrifices, so cut these unnecessary expenses.

Remember, you need to pay for rent, food, and actually needs in order to survive.

After you trim these expenses, you need to take it one step further if you really wish to survive and live on a tight budget.

Call your current billing cycle and ask if for better rates.

For example, if you do keep your phone line because you need it for an emergency, can they give the most basic of all plans?

Can you get a better rate on your car insurance even if it’s for 6 months?

My husband had a student loan and they managed to pause all payments for 6 months and this really helped us a lot seeing as we were on a tight budget.

2. Create A Plan for Living on One Income

If you know that you will be living on one income, you need to make a serious plan on how you will manage that income.

Who is making the money within the family? How much money are they bringing home after taxes?

Is the money enough that it will be able to cover all the necessary bills every month?

What happens if you can not pay your bills even when you have trimmed as many expenses as you possibly can?

Ask all of these questions openly and create a plan to address the shortfalls if any! You can’t ignore your mortgage otherwise you will lose your house.

For example, I created a plan of 30 ways to make money fast to pay for piling bills.

Also, do not ignore your debts!

Instead, I also had a plan for paying off debt fast even with a low income! Just sit down and make a plan that will work for the best.

You can even get the help of a financial advisor if you are not sure where to begin.

Most banks offer these services free of charge, so consult.

And if you are not sure what else you can cut and adjust, it’s always a great idea to track your daily spending and then do an adjustment based on that when you have a better idea.

Be sure to grab this spending tracker right now.

It’s completely free.

3. Create a Realistic Budget that Works

3. Create a Realistic Budget that Works

If you know that you are going to be living on a tight budget, you need to work with a budget! A good budget that will work when things are tight.

Write down to the penny exactly how much cash is coming in and how much will be spent on bills, food, and necessities.

If you haven’t already, please grab this spending tracker we mentioned above to help and keep you organized.

Make sure you are doing everything to track every single penny you are spending otherwise things might slide through the cracks.

I will give you a much clearer picture of where your hard-earned income is going.

Living on a tight budget requires you to become better at managing the money you do already have.

Hence we are stressing that you track every penny.

If money is not tracked accordingly and something is missed, you might overspend thinking you actually do have that money.

And spending money that you do not have will only get you further into the hole.

If you are not sure how to create a manageable budget, check out these FREE Monthly budget template printables you can use to start a household budget.

4. Spend Money Wisely When On A Tight Budget

You know you are living on a tight budget and that money will be much tighter on certain days.

This means you really need to learn how to spend money wisely now!

If you can look up specials on certain products you need, or if you can wait for that deal as well as consider shopping when things go on sale then please do that.

Doing simple things like this will keep you within your budget and you will have more money on hand.

Here are a few more ways to spend money wisely while living on a tight budget:

- Don’t eat out a lot, invite friends over and make meals together

- Avoid going to the movies frequently. Host a movie night instead

- Take the bus instead of driving around and wasting gas

- Find online shopping hacks to help save more money

- Shop for seasonal items when applicable

- Use a shopping list when you go grocery shopping

- Find ways to have fun at home instead of going out

- Work out from home and get rid of your gym membership

If you can find ways to cut out expenses while living on a tight budget, you will manage just perfectly!

5. Use Cash For Daily Expenses

Pay your regular bills as you normally would!

However, for all other expenses, try using cash. It’s much easier to control money going in or money going out if you have it in your hands.

Using a credit card or your debit card to shop will make you overspend. It’s is easier for people to tap here and there than to part with cash on hand.

Avoid going out of the house with your credit cards and debit cards at all costs if you can especially if you are really on a tight budget.

You will have no choice but stick to your budget and plan.

In fact, while living on one income, be sure to permanently or temporarily get rid of your cards.

From now on, when you go grocery shopping, or if you are pumping gas, try to use cash bills to pay.

I like to use the jar method, where I label the jars with all my expenses and grab the cash in that particular jar when needed.

For example, I will have a food jar, a transportation jar, and so on.

I will put my monthly allowance in the appropriate jar and when the money runs out, it runs out. This method will force you to properly manage your money.

It’s like giving yourself an allowance!

6. Understand Why You are Living on One Income

Living on a tight budget can be very stressful for a lot of people. And it can even be harder for those that are the only primary providers.

I know a lot of marriages and friendships that have broken up due to this fact.

If you are relying on the one person to provide for all your needs, it starts to get hard as things go on.

As a married person that was once living on a tight budget, I can tell you that things did get heated at times.

Having just one person handling all the finances is really unhealthy and can lead to a lot of resentment towards the person not bringing anything in.

It can only work if you both decide to get on the same page and work together.

It’s a good idea to think back and understand why you are in that situation in the first place.

By understanding the situation, you might find a little peace in that. So many people choose to live in this situation for many reasons such as:

- Just having a baby or raising a family

- Low employment rates in your area/ Lack of jobs

- Illness and disabilities that do not allow you to work

- Widow/ loss of family member/ forced to be a single parent

- Loss of job

They are so many reasons for living on one income or on a tight budget so definitely stay positive and stick to what is working for you and your family.

7. Find Ways To Increase Your Income

If money is really tight, find ways to increase your income if you are the one responsible for bringing in the money.

It could mean asking for raise at work, working longer hours, or temporally getting a part-time job.

And if you are the one staying at home, finding ways to make extra money from home should be your priority.

For example, you can find legit passive income ideas to help increase your income for extra cash.

Find out more about how one amazing lady made over $47, 000 working from home as a proofreader, or try using these apps that pay you real money!

You may also want to consider becoming a Pinterest Virtual Assistant on the side. Or even trying out these high paying side jobs to quickly make extra money to help around the house.

When we were really desperate during certain months, I want around my house and found 15 household items sell for quick cash.

If I didn’t do that, I was certain that I was going to lose my car.

I was so behind in car payments.

Once I was caught up, I knew that I didn’t want to be in this situation ever again, so I worked on creating an “in case of an emergency” binder for family.

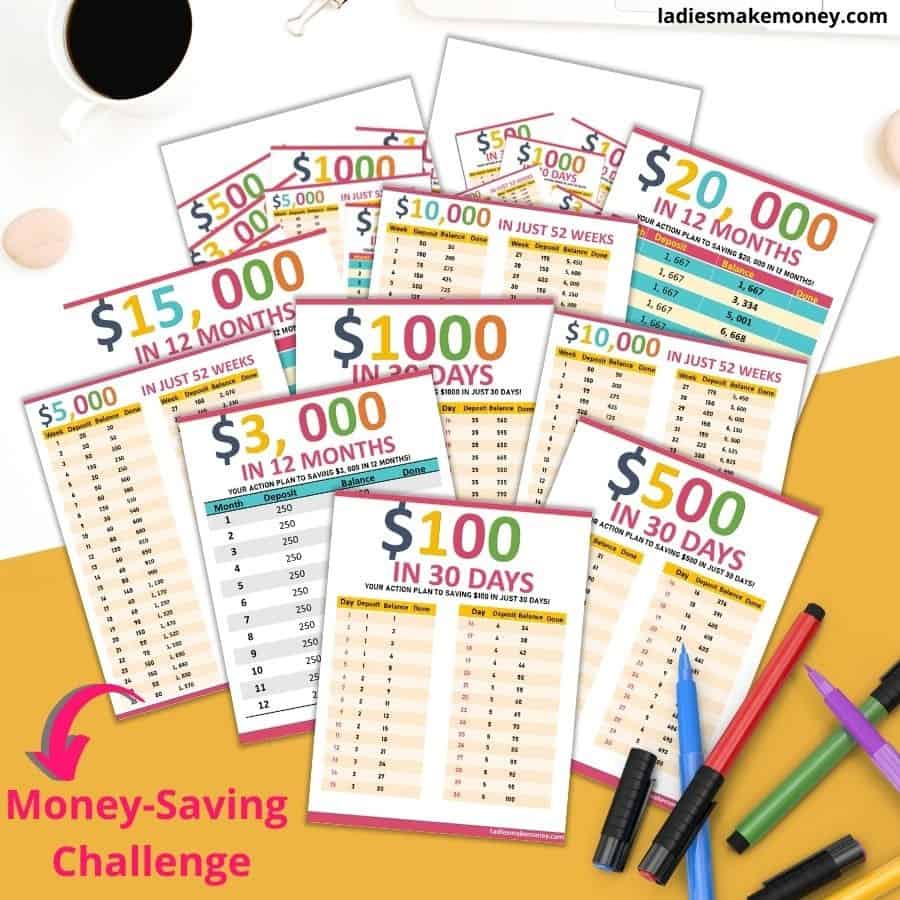

I also decided to try out a money-saving challenge to help replenish my account.

You can find my personal money-saving challenges right here.

They helped me a lot back then and I still use them to this day when I need a boost in savings.

You can also choose to participate in my no-spend challenge that you can also get here.

Just try to find a way to bring extra income to make living on a tight budget possible and realistic.

Related Tips for Living on a budget:

- 7 Profitable Side Business Ideas to Start While Working A Full-time Job

- 7 Quick Ways to Make Extra Income Working Full time Fast

Living on An Extreme Budget

How about some of you who are living on a shoestring budget? How can you manage with the little to no money that you may have?

I really suggest meeting up with a financial adviser or a financial expert to help you get through living on an extreme budget.

Missing bill payment will not make the situation better for you, it’s best to get the help you can before things become ugly and it gets harder to get out of.

Remember, asking for help is not a bad thing.

YouTube is also a great resource for finding tips for living on a tight budget.

For example, I watched this amazing video where Jordan shares grocery shopping hacks and how to save big money at the groceries!

Did you like our list of tips for living on a tight budget?

If so, we would love to hear from you in the comments below. Be sure to tell us about any tips you may have about living on one income.

And don’t forget to sign up for this free-spending tracker today!

Find more money-saving blog posts here!

If you enjoyed our blog we would like to have you join our email list and receive weekly money-making tips, you can join now! Don’t forget to like the Facebook page. The page is created to share your work, pitch your services, and learn from other experienced bloggers!

***We would like to note that this post and most posts on our blog may contain affiliate links. This means that if you purchase something that has an affiliate link, we will get a commission from it. Not all items recommended on our site are affiliate links. We only recommend items that we have used and tried. These items have brought us much success and we highly recommend them to you in order to be successful. Thank you for your trust!

How Living On A Tight Budget Is Not A Bad Thing, Here is Why It’s Not!

How Living On A Tight Budget Is Not A Bad Thing, Here is Why It’s Not!

Very great post.

I just stumbled upon your blog and wanted to say that I have truly loved browsing your blog posts.

In any case I will be subscribing on your feed and I hope you write again very soon!

Feel free to visit my website ✅

온라인 카지노 게임

스포츠 토토 일정

토토 라이브 스코어

온라인 카지노 사이트

안전 카지노 사이트

https://www.j9korea.com

Your writing is perfect and complete. totosite However, I think it will be more wonderful if your post includes additional topics that I am thinking of. I have a lot of posts on my site similar to your topic. Would you like to visit once?

Everything you bring to the public is amazing. how do you You think of a lot of content. And it’s great.

Pug Puppies for Sale Near Me

pugs puppies for sale

teacup pugs for sale

pug puppies for sale by owner

pug puppies ohio

PUG PUPPY FOR SALE NEAR ME

PUG PUPPIES FOR SALE

pug puppies for sale in kentucky

Pug Puppies for Sale Under $500 Near Me

pug puppies for sale in texas

pug puppies for sale $200

pugs for sale near me under $500

pugs for sale under $400 near me

pugs for sale near me

puppies for sale near me under $500

pug puppies for sale under $1,000 near me

pug for sale

pug puppies for sale under $300

Brindle Pug

Pitbull Pug Mix

Pugs for sale cheap

Cheap pug

affordable pug puppies for sale near me

black pugs for sale near me

White Pugs for sale

pug dog for sale

free pug puppies

pug puppies for sale in my area

mn pug breeders

pug puppies indiana

pugs for sale michigan

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

PUG PUPPY ADOPTION

Pug puppies for sale

Pug puppies for sale near me

Pug puppies near me

Pug Puppies for Sale Under $500 Near Me

Cute Pug Puppies

Black pug puppies

Black pug puppies for sale

pug puppies for adoption

black pug puppies for sale near me

chihuahua pug mix puppies

how much is a pug puppy

teacup pug puppies

baby pug puppies

baby pug puppies for sale

pictures of pug puppies

pug puppies for sale in Ohio

pug puppies price

pug mix puppies

teacup pug puppies for sale

best food for pug puppy

newborn pug puppies

pug puppies craigslist

pug puppies for sale craigslist

adorable pug puppies

how much does a pug puppy cost

Pitbull pug mix puppies

pug pit mix puppy

pug puppies for sale $200

pug puppies for sale in NJ

Pug puppies for sale in Wisconsin

pug puppy cost

pug puppy food

royal canin pug puppy

royal canin pug puppy food

fawn pug puppy

pug puppies for sale florida

pug puppies for sale in Indiana

pug puppies for sale in KY

pug puppies for sale in NC

pug dog puppy

AKC Registered Pug Puppies For sale

cheap pug puppies for sale near me

cheap pug puppies for sale in California

cheap pug puppies for sale in nj

Black Pug Puppies for sale

pugs puppies for sale

Pug Puppies for Sale Near Me

pugs puppies for sale

teacup pugs for sale

pug puppies for sale by owner

pug puppies ohio

PUG PUPPY FOR SALE NEAR ME

PUG PUPPIES FOR SALE

pug puppies for sale in kentucky

Pug Puppies for Sale Under $500 Near Me

pug puppies for sale in texas

pug puppies for sale $200

pugs for sale near me under $500

pugs for sale under $400 near me

pugs for sale near me

puppies for sale near me under $500

pug puppies for sale under $1,000 near me

pug for sale

pug puppies for sale under $300

Brindle Pug

Pitbull Pug Mix

Pugs for sale cheap

Cheap pug

affordable pug puppies for sale near me

black pugs for sale near me

White Pugs for sale

pug dog for sale

free pug puppies

pug puppies for sale in my area

mn pug breeders

pug puppies indiana

pugs for sale michigan

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

PUG PUPPY ADOPTION

Pug puppies for sale

Pug puppies for sale near me

Pug puppies near me

Pug Puppies for Sale Under $500 Near Me

Cute Pug Puppies

Black pug puppies

Black pug puppies for sale

pug puppies for adoption

black pug puppies for sale near me

chihuahua pug mix puppies

how much is a pug puppy

teacup pug puppies

baby pug puppies

baby pug puppies for sale

pictures of pug puppies

pug puppies for sale in Ohio

pug puppies price

pug mix puppies

teacup pug puppies for sale

best food for pug puppy

newborn pug puppies

pug puppies craigslist

pug puppies for sale craigslist

adorable pug puppies

how much does a pug puppy cost

Pitbull pug mix puppies

pug pit mix puppy

pug puppies for sale $200

pug puppies for sale in NJ

Pug puppies for sale in Wisconsin

pug puppy cost

pug puppy food

royal canin pug puppy

royal canin pug puppy food

fawn pug puppy

pug puppies for sale florida

pug puppies for sale in Indiana

pug puppies for sale in KY

pug puppies for sale in NC

pug dog puppy

AKC Registered Pug Puppies For sale

cheap pug puppies for sale near me

cheap pug puppies for sale in California

cheap pug puppies for sale in nj

Black Pug Puppies for sale

pugs puppies for sale

Thanks for sharing this nice blog. And thanks for the information. Will like to read more from this blog.

Comprare Patente di Guida

Comprare Patente B

Comprare Patente C

Comprare Patente CQC

Acquista una patente di guida senza esami

Führerschein

FÜHRERSCHEIN ONLINE KAUFEN

fuhrerschein-kaufen

Mpu kaufen, legal & ohne Prüfung

Pug Puppies for Sale Near Me

pugs puppies for sale

teacup pugs for sale

pug puppies for sale by owner

pug puppies ohio

PUG PUPPY FOR SALE NEAR ME

PUG PUPPIES FOR SALE

pug puppies for sale in kentucky

Pug Puppies for Sale Under $500 Near Me

pug puppies for sale in texas

pug puppies for sale $200

pugs for sale near me under $500

pugs for sale under $400 near me

pugs for sale near me

puppies for sale near me under $500

pug puppies for sale under $1,000 near me

pug for sale

pug puppies for sale under $300

Brindle Pug

Pitbull Pug Mix

Pugs for sale cheap

Cheap pug

affordable pug puppies for sale near me

black pugs for sale near me

White Pugs for sale

pug dog for sale

free pug puppies

pug puppies for sale in my area

mn pug breeders

pug puppies indiana

pugs for sale michigan

PUG PUPPY ADOPTION

Pug puppies for sale

Pug puppies for sale near me

Pug puppies near me

Pug Puppies for Sale Under $500 Near Me

Cute Pug Puppies

Black pug puppies

Black pug puppies for sale

pug puppies for adoption

black pug puppies for sale near me

chihuahua pug mix puppies

how much is a pug puppy

teacup pug puppies

baby pug puppies

pictures of pug puppies

pug puppies for sale in Ohio

pug puppies price

pug mix puppies

teacup pug puppies for sale

best food for pug puppy

newborn pug puppies

pug puppies craigslist

pug puppies for sale craigslist

adorable pug puppies

how much does a pug puppy cost

Pitbull pug mix puppies

pug pit mix puppy

pug puppies for sale $200

pug puppies for sale in NJ

Pug puppies for sale in Wisconsin

pug puppy cost

pug puppy food

royal canin pug puppy

royal canin pug puppy food

fawn pug puppy

pug puppies for sale florida

pug puppies for sale in Indiana

pug puppies for sale in KY

pug puppies for sale in NC

pug dog puppy

AKC Registered Pug Puppies For sale

cheap pug puppies for sale near me

cheap pug puppies for sale in California

cheap pug puppies for sale in nj

Black Pug Puppies for sale

pugs puppies for sale

pug puppies indiana

Amazing! This blog looks just like my old one!

It’s on a completely different subject but it has pretty much the same layout and design. Wonderful choice of colors!

https://www.gamja888.com/ – 바카라사이트,카지노사이트,카지노게임사이트,온라인바카라,온라인카지노,Gamja888

https://gamja888.com/ – 퀸즈슬롯

https://gamja888.com/ – 맥스카지노

https://gamja888.com/ – 비바카지노

https://gamja888.com/ – 카지노주소

https://gamja888.com/ – 바카라추천

https://gamja888.com/ – 온라인바카라게임

https://gamja888.com/ – 안전한 바카라사이트

https://gamja888.com/ – 바카라

https://gamja888.com/ – 카지노

https://gamja888.com/ – 퀸즈슬롯 카지노

https://gamja888.com/ – 바카라게임사이트

https://gamja888.com/onlinebaccarat/ – 온라인바카라

https://gamja888.com/millionclubcasino/ – 밀리언클럽카지노

https://gamja888.com/safecasinosite/ – 안전카지노사이트

https://gamja888.com/baccaratsiterecommendation/ – 바카라사이트추천

https://gamja888.com/ourcasino/ – 우리카지노계열

https://gamja888.com/slotmachine777/ – 슬롯머신777

https://gamja888.com/royalcasinosite/ – 로얄카지노사이트

https://gamja888.com/crazyslot/ – 크레이지슬롯

https://gamja888.com/onlineblackjack/ – 온라인블랙잭

https://gamja888.com/internetroulette/ – 인터넷룰렛

https://gamja888.com/casinoverificationsite/ – 카지노검증사이트

https://gamja888.com/safebaccaratsite/ – 안전바카라사이트

https://gamja888.com/mobilebaccarat/ – 모바일바카라

https://gamja888.com/howtowin-baccarat/ – 바카라 필승법

https://gamja888.com/meritcasino/ – 메리트카지노

https://gamja888.com/baccarat-howto/ – 바카라 노하우

youube.me

instagrme.com

youubbe.me

Instagrm.me

Instagrme.net

internetgame.me

instagrme.live

naverom.me

facebokom.me

https://www.instagrme.com/ – 바카라사이트,우리카지노,온라인바카라,카지노사이트,실시간바카라

https://instagrme.com/ – 퀸즈슬롯

https://instagrme.com/ – 바카라게임

https://instagrme.com/ – 카지노주소

https://instagrme.com/ – 온라인카지노

https://instagrme.com/ – 온라인카지노사이트

https://instagrme.com/ – 바카라게임사이트

https://instagrme.com/ – 실시간바카라사이트

https://instagrme.com/ – 바카라

https://instagrme.com/ – 카지노

https://instagrme.com/woori-casino/ – 우리카지노

https://instagrme.com/theking-casino/ – 더킹카지노

https://instagrme.com/sands-casino/ – 샌즈카지노

https://instagrme.com/yes-casino/ – 예스카지노

https://instagrme.com/coin-casino/ – 코인카지노

https://instagrme.com/thenine-casino/ – 더나인카지노

https://instagrme.com/thezone-casino/ – 더존카지노

https://instagrme.com/casino-site/ – 카지노사이트

https://instagrme.com/gold-casino/ – 골드카지노

https://instagrme.com/evolution-casino/ – 에볼루션카지노

https://instagrme.com/casino-slotgames/ – 카지노 슬롯게임

https://instagrme.com/baccarat/ – baccarat

https://instagrme.com/texas-holdem-poker/ – 텍사스 홀덤 포카

https://instagrme.com/blackjack/ – blackjack

youube.me

gamja888.com

youubbe.me

Instagrm.me

Instagrme.net

internetgame.me

instagrme.live

naverom.me

facebokom.me

https://www.youubbe.me/ – 카지노사이트,바카라사이트,슬롯사이트,온라인카지노,카지노주소

https://youubbe.me/ – 카지노검증사이트

https://youubbe.me/ – 안전한카지노사이트

https://youubbe.me/ – 슬롯카지노

https://youubbe.me/ – 바카라게임

https://youubbe.me/ – 카지노추천

https://youubbe.me/ – 비바카지노

https://youubbe.me/ – 퀸즈슬롯

https://youubbe.me/ – 카지노

https://youubbe.me/ – 바카라

https://youubbe.me/ – 안전한 바카라사이트

https://youubbe.me/ – 온라인슬롯

https://youubbe.me/casinosite/ – 카지노사이트

https://youubbe.me/baccarat/ – 바카라

https://youubbe.me/baccaratsite/ – 바카라사이트

https://youubbe.me/pharaoh-casino/ – 파라오카지노

https://youubbe.me/제왕카지노/ – 제왕카지노

https://youubbe.me/mgm카지노/ – mgm카지노

https://youubbe.me/theking-casino/ – 더킹카지노

https://youubbe.me/coin-casino/ – 코인카지노

https://youubbe.me/solaire-casino/ – 솔레어카지노

https://youubbe.me/casino-game/ – 카지노게임

https://youubbe.me/micro-gaming/ – 마이크로게이밍

https://youubbe.me/asia-gaming/ – 아시아게이밍

https://youubbe.me/taisan-gaming/ – 타이산게이밍

https://youubbe.me/oriental-game/ – 오리엔탈게임

https://youubbe.me/evolution-game/ – 에볼루션게임

https://youubbe.me/dragon-tiger/ – 드래곤타이거

https://youubbe.me/dream-gaming/ – 드림게이밍

https://youubbe.me/vivo-gaming/ – 비보게이밍

youube.me

gamja888.com

instagrme.com

Instagrm.me

Instagrme.net

internetgame.me

instagrme.live

naverom.me

facebokom.me

https://www.youube.me/ – 카지노사이트,바카라사이트,바카라게임사이트,온라인바카라,인터넷카지노

https://youube.me/ – 퀸즈슬롯

https://youube.me/ – 카지노주소

https://youube.me/ – 비바카지노

https://youube.me/ – 카지노추천

https://youube.me/ – 카지노게임

https://youube.me/ – 온라인카지노사이트

https://youube.me/ – 카지노

https://youube.me/ – 바카라

https://youube.me/ – 온라인카지노

https://youube.me/ – 카지노게임사이트

https://youube.me/sandscasinoaddress/ – 카지노검증사이트

https://youube.me/royalcasinoseries/ – 로얄카지노계열

https://youube.me/slotmachinesite/ – 슬롯머신사이트

https://youube.me/maxcasino/ – 맥스카지노

https://youube.me/baccaratgamesite/ – 바카라게임사이트

https://youube.me/casimbakorea-casino/ – 카심바코리아 카지노

https://youube.me/mobilecasino/ – 모바일카지노

https://youube.me/real-timebaccarat/ – 실시간바카라

https://youube.me/livecasino/ – 라이브카지노

https://youube.me/onlineslots/ – 온라인슬롯

https://youube.me/sandscasinoaddress/ – 바카라 이기는방법

https://youube.me/safecasinosite/ – 안전카지노사이트

https://youube.me/ourcasinosite/ – 우리카지노사이트

https://youube.me/sandscasinoaddress/ – 샌즈카지노주소

https://youube.me/baccarat-rulesofthegame/ – 바카라 게임규칙

https://youube.me/baccarat-howtoplay/ – 바카라 게임방법

gamja888.com

instagrme.com

youubbe.me

Instagrm.me

Instagrme.net

internetgame.me

instagrme.live

naverom.me

facebokom.me

Have you ever had a situation where everything seems to be fine in a relationship, but you want to diversify somehow? My nephew suggested to his girlfriend to click this site and find a girl there for a threesome. He believes that everyone should try it sometimes in order to prevent boredom and the desire to cheat behind their backs from entering their bed. They have been experimenting like this for a couple of months and both are happy.

Are you considering a minibus hire with comfort and safety? Coach hire minibus If you want to hire a clean and comfortable coach at an affordable price, then you’re at the right place! Here at Low Cost Coach Hire, you’ll find a chance to hire good quality and minibus service.

Fantastic article post.Much thanks again. Keep writing.

A big thank you for your blog post. Will read on…

Such a good job and love the article! Thank you

Such incredible advice from so many awesome sources! I love it!

I have realized massive information from here. I am ready for your updates.

Thanks so much for this post. We are always looking for ways to be more frugal and live on a tight budget and there were many great ideas here. I like that you added the ways you can still have fun while living on a budget. Also loved some of your suggestions for making a little extra money! Thanks!

These are really great tips for downsizing for a tight budget. We recently made some deeper cuts to the budget, it wasn’t easy, but it will help in the long run.

Thanks for the interesting and useful post. I much prefer to live on a tight budget. I think that generally people spend/waste too much money on things that aren’t good for them, aren’t good for the environment, aren’t good for anything. If we live on a tight budget then we’re much more able to make healthy and useful choices. Thank you! 🙂

These are wonderful tips. I for the most part stay true to my monthly budget but the occasional dinners out, gets me, as I’m sure many others can relate! Definitely something I would like to cut back on!

-Madi xo | http://www.everydaywithmadirae.com