Last Updated on January 14, 2021 by NandiNN

10 habits of successful people

Like everyone else, I also wanted to know the habits of financially successful people.

What made them successful?

What did they do every day to help them accomplish their goals to become financially free?

It’s no secret that many financially successful people today weren’t born with silver spoons.

And to be where they are right now is obviously not a one-way process.

I really wanted to dig deep to analyze and find some of the top habits of successful people!

Obviously, I want to be successful too, don’t you?

We will be covering a lot of goodies today.

Here is what to expect:

-

Best tips to be financially successful people

-

Tips to gain good financial habits

-

Ways to be financially successful even with little money

-

The daily habits of successful people

Come prepared as we have a lot to cover today.

If you want to be successful, you need to adapt and follow the habits of successful people.

It’s that simple.

A few reasons why they became financially stable in the first place is because they live life with good habits.

Meaning, they are always making great financial decisions.

Here is an epic list of a few financial advice for women you can follow this year to grow your money.

As you can see, having good money habits can really help people become financially successful.

Now, if you have a goal of becoming financially free and would like to learn more about how to successfully make sense of your income, join our 30 Money Challenge where we will share actionable tips you can use to succeed with money.

Go ahead and sign up right here.

So what are the daily habits of highly successful people?

Before we get started on some of the best habits of financially successful people, we did want you to follow us on Facebook for more awesome ideas on saving or making more money. You can also follow us on Instagram for more tips.

We also wanted to take the opportunity to let you know that we use Affiliate links on some of our blog posts. This means that we could make a commission if you click on an affiliate link and purchase something. Read our full disclosure and blog policy for more information.

Making decisions to improve your finances takes gut and it is no easy task to embark on.

And learning from the best will only get you closer to your own financial goals.

In my opinion, financial success is being able to live comfortably within your means and being able to reach your financial goals within the time frame you set for yourself.

And this takes a lot of discipline.

Qualities and traits of financially successful people differ from person to person and it is important that you form the right habits if you want to be just as successful financially.

With this in mind, we can get right into what habits you need to form to become a successful financial person.

10 Financial Habits Of Highly Successful People

1. Invest Your Money

Many financially successful people make a habit of investing their money into something that can help them become more financially secure.

The financially fit always seek alternatives to grow their money.

Whether it’s an investment that yields a small or big income, it doesn’t matter as long as they’re investing money.

Keep in my mind that investments always come with risks so you definitely want to do some research and maybe consult.

My recommendation is to definitely start small and work your way up.

I would start small with something like Acorn which allows you to invest for as low as $5.00!

I also found this YouTube video very helpful when it came to learning more about investments.

2. Save Money For Future Purposes

To become financially successful means making a habit of saving a significant amount of money for future needs.

During a financial emergency, these savings will help you get out of that situation.

However, saving up money can be hard, especially for those struggling to make ends meet.

October is typically Financial Planning Month, making this the perfect time to sit down and evaluate your personal financial situation.

But you do not need to wait for October to get your finances in order.

In fact, one of the habits of financially successful people is all about thinking ahead.

Plan for the future as you never know what could happen.

But if you have a specific aim or objective for setting aside money, it makes saving easier.

Not sure how to start setting aside money slowly, be sure to grab this tool!

3. Avoid Debt as Much as Possible

There are instances when we are forced to borrow money to cover emergency expenses.

This happens even to the best of us.

So I really do understand that.

But over time, the amount your borrow will slowly start affecting your day-to-day life especially financially.

One of my biggest debt at one time was my car.

Now that that’s paid off, I am slowly working towards getting rid of credit card debts using this method!

Nobody likes living from paycheck to paycheck and only having all that money go to debt.

It’s just too much stress.

That’s why financially successful people always make a habit of preventing themselves from getting into any debt.

They obviously do not want to be in a situation where all their savings are only intended to pay off the money they owe.

If I could go back to my younger self, 5 years ago, I would tell myself to earn it before spending it.

More tips to pay off debt:

- Paying off debt fast even with a low income

- Brilliant hacks on becoming debt-free without filing for bankruptcy

4. Going to Work and Working Hard

In life, becoming financially successful means having a good source of income.

Many financially stable people have a healthy habit of always going to work and doing their best.

For many, a good source of income is a great motivating factor that drives them to earn more money.

Finding creative ways to increase income, is usually always their priority.

If you can make more money, then you can have more to pay off debt, put in a savings account or you can even have more money for investing.

However, if you are always missing work or continuously under-perform, it will result in you losing your job!

This can definitely lead to financial instability.

An additional concern is the viability of the company that employs you.

During a financial crisis due to things such as the pandemic, a lot of people lost their jobs.

Many were let go and were obviously left to struggle financially.

Definitely having an emergency fund is needed.

5. Create a Budget Plan

Financially successful people have a habit of creating a budget plan.

Guys, a budget is only the best way to ensure you know exactly what is going on with your money.

For those that are financially stable, budgeting and tracking are absolutely important to your success of wanting to have more money in the bank.

Financially fit people are always tracking where their money is going and you should do the same.

The goal is to arrange, coordinate, monitor, and change your financial expenses according to the budget you have set for yourself.

This will help you manage your expenses properly, allowing you to save a part of your income.

Here is a list of over 17 places you can find free monthly budget templates you can use to budget your money.

6. Manage Daily Expenses

The habit of managing daily expenses is a good indication that you are conscious of how your money is being spent every day.

The goal is to ensure that you are not overspending.

Financially successful people always keep track of how they spend their money daily and compare it with their past expenses.

This is a big help for them as they can quickly and easily see where they need to adjust their future expenses to avoid wasting money and become more financially stable.

If you can do a no-spend challenge, you will be surprised at how much you could save each month.

I can tell you that spending $5.00 today, $5.00 the next day can quickly add up.

I kept a record of how much I spend on coffee each day for a week and it cost me just over $3000.00!

This is on coffee.

I bought an average of 2-3 cups a day in coffee that cost me about $4.00 a cup.

And I drink coffee every single day.

Do the math.

I could have used that $3000 to pay a credit card bill.

Be sure to grab this spending tracker right now to track your money.

It’s completely free.

7. Always Consider the Future

Many financially successful people have a habit of always considering what’s ahead of them.

Being financially stable today isn’t a guarantee that it is the same thing in the future.

Therefore, many of these people invest in something they might use in the future, such as setting up a pension payment and investing money.

Always think about the future.

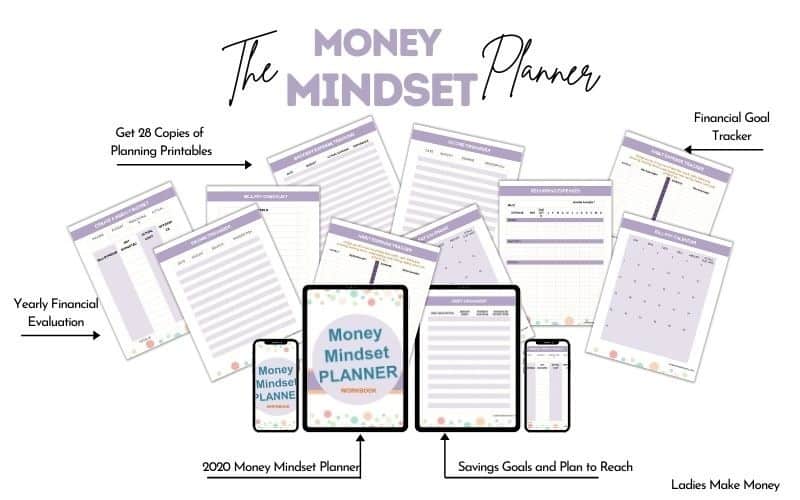

Be sure to grab this epic Money Mindset Planner to help you get your finances in order.

It’s one of the best planners to help you plan for the future financially.

This pack includes 28 pages to help you get your finances and money mindset on track whether your goal is to save more, get out of debt, or simply managing your money better.

Get a full breakdown of what is included right here.

8. Prioritize Needs Over Wants

Among some of the habits of financially successful people, I love this tip the most.

Many do not prioritize their wants and tend to overspend in this area the most.

One of the best ways of becoming financially successful is the habit of prioritizing your needs over wants.

Many people do not know their life priorities, which often leads to wasting their money by buying enticing products to feed their desires.

Obviously, you will not become financially free if this is the way you do things over and over.

However, if you prioritize what’s necessary, you will be assured that your money will be used on important things, which can help you save up.

9. Review Billing Updates

Do you frequently check your bills to really see what you are paying for?

I did not do this for the longest time until I married a guy that is so into finances.

He checks every single thing and ensures our bills are always paid before anything else. This is one of the many habits of financially successful people.

They question anything that sticks out and will not pay for something that does not belong.

You need to start paying attention to your bills.

And if anything out of the ordinary sticks out, call to find out why they charged you for it.

If you plan to be financially free, you will want to start paying attention to your money.

It may seem like a lot of work, but this is a good habit to get into so that you can become more aware of any unreasonable charges.

Checking your billing statements can help you save money by helping identify and argue excessive charges.

10. Never Stop Learning

Continuously learning in life is a smart habit of many financially successful people.

It’s a life skill that can hone one’s decision making.

When you are financially stable, your decision must be accompanied by wisdom to avoid being overwhelmed by this ever-changing world.

By being open to new knowledge, you’ll give yourself countless possibilities to earn and save money.

I honestly use YouTube to learn more and I have also purchased amazing books to help with my learning.

I just bought The Clever Girl Finance: Ditch debt, save money, and build real wealth on Amazon.

I am loving and once done, expect to read my full review.

You can also check out: Successes, Struggles, and Tips: How To Survive With Little Money!

It’s packed with amazing tips on what you can do to make your money last longer, places to cut, and how to make extra money quickly.

If you are constantly worrying about money, then you need that guide.

You can definitely find a lot of amazing and affordable finance books on Amazon like these:

- You Are a Badass at Making Money: Master the Mindset of Wealth

- The 4-Hour Work Week: Escape the 9-5, Live Anywhere, and Join the New Rich

You will definitely learn epic tips about finances and the different habits successful people do to be financially wealthy!

There you have it, a list of 10 habits of successful people!

What makes someone financially successful?

In my opinion, financially successful people care about what they spend their money on.

They know where to spend, what not to spend on, and are very good at living within their means.

This includes reading up on having better money management.

I have recently taken a huge interest in investing as I believe having my money work for me will be financially rewarding in the future.

Having smart financial decisions like these definitely pay off in the long run!

Benefits of being financially stable

In life, there’s always a reason why most people are financially successful.

Good habits play a major part in strengthening everyone’s finances.

Therefore, if you want to be financially secure in life, start making your own habits and be disciplined enough not to stray far from them.

The habits mentioned above are just a few things you can practice to have a more financially sound present and future.

When you become financially stable:

- You tend to be less stressed

- You will enjoy life better

- You will also have the freedom to do as you please

- You will have more options in life

- And you will better opportunities

Do your hardest to work on your finances this year and commit to at least one step at a time.

You can also check out this list of over 10 books every entrepreneur should read this year.

We listed a lot of great books for you that will truly help you with your finances.

Don’t forget to join our 30 Day Money Challenge where we will share actionable tips you can use to succeed with money.

Read next for tips and habits of financially successful people:

- How to become a millionaire from nothing (15 things to focus on)

- Dream Life VS Dream Career – How to make it work & succeed

Author’s Bio

Karla Lopez spent most of her years studying marketing and financial planning. Now, she works with customers from various industries and uses her marketing experiences to help their business. Her undying passion for assisting people when it comes to financial management is her motivation to work in this field.

If you enjoyed our blog we would like to have you join our email list and receive weekly money-making tips, you can join now! Don’t forget to join our Private Facebook page. The page is created to share your work, pitch your services, and learn from other experienced bloggers!

***We would like to note that this post and most posts on our blog may contain affiliate links. This means that if you purchase something that has an affiliate link, we will get a commission from it. Not all items recommended on our site are affiliate links. We only recommend items that we have used and tried. These items have brought us much success and we highly recommend them to you in order to be successful. Thank you for your trust!

Crystal meth Where to buy Online | Meth crystal for sale online | https://crystalmethbuy.com/

Buy Crystal Meth Online Europe | Buy Adderall Pills | Order Crystal Meth Reliable Suppliers

where to buy crystal meth | buy crystal meth online | buy crystal meth | buy pure crystal meth online | crystal meth buy online | where can i buy crystal meth | where to buy crystal meth | best place to buy crystal meth | buy cheap crystal meth | buy cheap crystal meth online | buy crystal meth and pills | buy crystal meth blue online | buy crystal meth cheap | buy crystal meth drug house santa ana | buy crystal meth from china | buy crystal meth in minutes | buy crystal meth methamphetamine online | buy crystal meth online australia | buy crystal meth online discreet packageing | buy crystal meth online uk | buy crystal meth online usa | buy crystal meth online with bitcoin

https://crystalmethbuy.com/

We have been selling Crystal meth & Adderall 30mg Pills online since 2012 over the deepweb with darknet and we’ve seen many changes over the years. We started out small and focused on providing high quality products at affordable prices. Now we’re one of the largest Reliable suppliers of crystal meth for sale online. Our mission is to provide our customers with everything they need to conduct their own experiments. We offer free shipping on orders over $2000 and fast discreet shipping. If you have any questions please don’t hesitate to contact us.

Wickr ID: methsuppliers

Email: [email protected]

https://crystalmethbuy.com/

https://crystalmethbuy.com/crystal-meth/

https://crystalmethbuy.com/product/blue-crystal-meth-for-sale/

https://crystalmethbuy.com/product/buy-adderall-30mg-ir/

https://crystalmethbuy.com/product/buy-amphetamine-speed/

https://crystalmethbuy.com/product/buy-dutch-crystal-meth-online/

https://crystalmethbuy.com/product/buy-ritalin-20mg-methylphenidate/

https://crystalmethbuy.com/product/buy-vyvanse-70mg-lisdexamfetamine-online/

Where to Order Troparil Powder, Order Ephedrine hcl, Buy Oxycodone, Buy Isotodesnitazene, Buy Etazene, Buy Fentanyl, Buy Carfentanil, Heroin for sale,

Buy Isopropylbenzylamine, Buy 1,4-Butanediol OBO, Buy Clonazolam, Buy k2 Spice Powder, Buy 3CMC, GHB, JWH018, 2Fdck, Buy 4MMC, Buy Crystal Meth, Ketamine for sale, Nembutal Pentobarbital

We provide research chemicals and other pharmaceutical raw powders with fast shipping and we do provide tracking number for all packages. we supply high quality research chemicals Powder purity 99% ,delivery is safe ,secured and guaranteed.

Where to Order Troparil Powder, Order Ephedrine hcl, Buy Oxycodone Powder, Buy Isotodesnitazene, Buy Etazene, Buy Fentanyl, Buy Carfentanil, Heroin for sale, Buy Isopropylbenzylamine, Buy 1,4-Butanediol OBO for sale, Buy Clonazolam Powder, Buy k2 Spice Powder, Buy 3CMC, GHB, JWH018, Buy Ketamine, 2Fdck, Buy 4MMC, Buy Crystal Meth, Ketamine for sale, Nembutal Pentobarbital are available in bulk now. https://pharmaceuticalpowders.com/

We have traded in this oil for 10 years and we guarantee all our clients quality oil, prompt delivery, safety and professional discretion.

Wickr ID: discreetvendors

https://pharmaceuticalpowders.com/

https://pharmaceuticalpowders.com/product/4f-adb-for-sale/

https://pharmaceuticalpowders.com/product/buy-gbl-online/

https://pharmaceuticalpowders.com/product/buy-etonitazene-online/

https://pharmaceuticalpowders.com/product/flubromazolam-powder-for-sale/

https://pharmaceuticalpowders.com/product/nitrazepam-powder-for-sale/

https://pharmaceuticalpowders.com/product/buy-2c-b-online/

https://pharmaceuticalpowders.com/product/buy-cocaine-hydrochloride-online/

https://pharmaceuticalpowders.com/product/buy-methamphetamine-crystal-meth/

https://buyesketamine.com/

https://buyesketamine.com/ketamine-clinic/

https://buyesketamine.com/product/buy-ketamax-500mg-10ml-injections/

https://buyesketamine.com/product/buy-ketamine-capsules-online/

https://buyesketamine.com/product/buy-ketamine-hcl-injectable-500mg-ml-10ml/

https://buyesketamine.com/product/buy-ketamine-powder-online/

https://buyesketamine.com/product/buy-ketamine-ketarol-500mg-10ml-injections/

https://buyesketamine.com/product/calypsol-500mg-injection-for-sale-online/

https://buyesketamine.com/product/ketamine-crystals-for-sale/

https://buyesketamine.com/product/ketamine-nasal-spray-compounded/

https://buyesketamine.com/product/tiletamine-100mg-ml-injection-for-sale/

https://buyesketamine.com/product/order-anesket-1000mg-10ml/

Buy Arcade1up Machines Online – Pinball Machine for sale – Slot Machine for sale – Arcade Game Machines for Sale Canada

– Buy Refurbished Pinball machine Online – Used Slot Machine For sale Cheap – Buy Arcade Games Online –Buy New Pinball Machine Online – Canada Slot Machine Suppliers Online – Game Machine for sale – Refurbished Coins Slot Machine buy online

https://arcade1upmachines.com/arcade-games-machines/

We have been selling Arcade Games for sale online since 2012 and we’ve seen many changes over the years. We started out small and focused on providing high quality products at affordable prices.

Now we’re one of the largest Reliable suppliers of Slot Machines and Arcade Game machines online. Our mission is to provide our customers with everything they need to conduct their own experiments. We offer free shipping on orders over $3000 and fast discreet shipping.

If you have any questions please don’t hesitate to contact us.

Email: [email protected]

Text:+1 (781) 469 – 0496

https://arcade1upmachines.com/

https://arcade1upmachines.com/arcade-games-machines/

https://arcade1upmachines.com/

https://arcade1upmachines.com/arcade-games-machines/

https://arcade1upmachines.com/product/addams-family-pinball-machine-by-bally/

https://arcade1upmachines.com/product/attack-from-mars-pinball-machine-by-bally/

https://arcade1upmachines.com/product/arcade-legends-3-with-over-100-games-including-golden-tee-space-invaders-centipede-asteroids/

https://arcade1upmachines.com/product/avatar-pinball-machine-by-stern/

https://arcade1upmachines.com/product/champion-pub-pinball-machine-by-bally/

https://arcade1upmachines.com/product/deadpool-premium-pinball-machine-by-stern/

https://arcade1upmachines.com/product/duck-catcher-crane/

https://arcade1upmachines.com/product/fast-furious-supercars-arcade-game/

https://arcade1upmachines.com/product/funhouse-pinball-machine-by-williams/

https://arcade1upmachines.com/product/game-of-thrones-pro-pinball-machine-by-stern/

https://arcade1upmachines.com/product/harley-davidson-3rd-edition-pinball-machine/

https://arcade1upmachines.com/product/indiana-jones-pinball-machine-2008-by-stern/

https://arcade1upmachines.com/product/medieval-madness-pinball-machine-by-williams/

https://arcade1upmachines.com/product/ms-pac-man-galaga-arcade-game/

https://arcade1upmachines.com/product/shelti-pro-foos-ii-foosball-table/

https://arcade1upmachines.com/product/shoot-to-win-basketball-arcade/

https://arcade1upmachines.com/product/simpsons-pinball-party-machine/

https://arcade1upmachines.com/product/star-wars-pro-pinball-machine-by-stern/

https://arcade1upmachines.com/product/teenage-mutant-ninja-turtles-arcade-game-1989/

https://arcade1upmachines.com/product/toy-soldier-crane/

https://arcade1upmachines.com/product/warrior-force-8-led-foosball-table/

https://arcade1upmachines.com/

https://arcade1upmachines.com/arcade-games-machines/

https://arcade1upmachines.com/product/addams-family-pinball-machine-by-bally/

https://arcade1upmachines.com/product/attack-from-mars-pinball-machine-by-bally/

https://arcade1upmachines.com/product/arcade-legends-3-with-over-100-games-including-golden-tee-space-invaders-centipede-asteroids/

https://arcade1upmachines.com/product/avatar-pinball-machine-by-stern/

https://arcade1upmachines.com/product/champion-pub-pinball-machine-by-bally/

https://arcade1upmachines.com/product/deadpool-premium-pinball-machine-by-stern/

https://arcade1upmachines.com/product/duck-catcher-crane/

https://arcade1upmachines.com/product/fast-furious-supercars-arcade-game/

https://arcade1upmachines.com/product/funhouse-pinball-machine-by-williams/

https://arcade1upmachines.com/product/game-of-thrones-pro-pinball-machine-by-stern/

https://arcade1upmachines.com/product/harley-davidson-3rd-edition-pinball-machine/

https://arcade1upmachines.com/product/indiana-jones-pinball-machine-2008-by-stern/

https://arcade1upmachines.com/product/medieval-madness-pinball-machine-by-williams/

https://arcade1upmachines.com/product/ms-pac-man-galaga-arcade-game/

https://arcade1upmachines.com/product/shelti-pro-foos-ii-foosball-table/

https://arcade1upmachines.com/product/shoot-to-win-basketball-arcade/

https://arcade1upmachines.com/product/simpsons-pinball-party-machine/

https://arcade1upmachines.com/product/star-wars-pro-pinball-machine-by-stern/

https://arcade1upmachines.com/product/teenage-mutant-ninja-turtles-arcade-game-1989/

https://arcade1upmachines.com/product/toy-soldier-crane/

https://arcade1upmachines.com/product/warrior-force-8-led-foosball-table/

CCTV installation is becoming increasingly popular for businesses and homeowners alike. It is a cost-effective way to provide peace of mind and security for your property, as well as deterring potential criminals from targeting your premises. cctv installation company

TBI Mauritius can assist you in company formation in Mauritius and guide you all along the way from business registration, explaining the different type of offshore companies in Mauritius, buying and setting up your workspace to hiring talented professionals and meeting the legalities with robustness and accuracy. Setting Up A Company In Mauritius

An event management platform is a software application that helps event planners to manage all aspects of their events, from start to finish. It enables event planners to track registrations, create and manage attendee lists, send out communications, and track event finances. Event Management Platform

We think it’s important that pizza be readily accessible around so you don’t have to second-guess your choice. Consider who would want to wait for hours to quench their hunger for pizza

RAPiZZA

Thanks for sharing this information keep it up.

Thanks for sharing this information with us.

goldpriceinpakistan.pk is Pakistan’s most reliable and up-to-date website for gold rates.

We provide our users with the latest information about the price of gold in both local and international markets,

as well as news and analysis about the industry. Our goal is to provide our readers with accurate, timely,

and easy-to-use information that will help them make informed decisions about their investments.

Gold Price in Karachi

Gold Price in Hyderabad

Gold Price in Sukkur

Gold Price in Multan

Gold Price in Faisalabad

Gold Price in islamabad

Gold Price in Lahore

South Indian Food is a unique blend of flavors and spices that makes it one of the most popular cuisines in India. From the aromatic curries to the delicious dosas, South Indian food has something for everyone. It is characterized by its use of fresh ingredients, vibrant spices, and flavorful combinations

Your writing is perfect and complete. casinocommunity However, I think it will be more wonderful if your post includes additional topics that I am thinking of. I have a lot of posts on my site similar to your topic. Would you like to visit once?

From some point on, I am preparing to build my site while browsing various sites. It is now somewhat completed. If you are interested, please come to play with casino online !!

Thanks for sharing this post i like it and again wants same like this.

mrf tractor tyres 14.9 28 price in india

Heya i’m for the first time here. I came across this board and I find It really useful & it helped me out much. I hope to give something back and aid others like you helped me. Sherlock Holmes Coat Wool Cape

Hello!!

Useful blog. thank you for sharing to us.

tractor trailer

On the hunt for a Best Shockwave Therapy Brampton, Orangeville, Malton? So New Hope Physiotherapy can provide relief from a range of conditions affecting joints, tendons and bones.

On the hunt for a Pelvic Floor Physiotherapy Brampton, Orangeville, Malton? So New Hope Physiotherapy can provide relief from muscles, joints, and nerves of the pelvis. Book Appointment Today!

Finding Best Physiotherapy Clinic in Brampton, On (905) 846-4000. So New Hope Physiotherapy Brampton offers Expert physiotherapist and massage therapy with reasonable prices. Book Appointment Today!

https://www.matchmaker.fm/podcast/sleduj-avatar-2-cel-film-onli-3484a1

Finding Best Physical Therapy Brampton, On (905) 846-4000. So New Hope Physical Therapy Brampton offers Expert physiotherapist and massage therapy with reasonable prices.

I’ve been troubled for several days with this topic. safetoto, But by chance looking at your post solved my problem! I will leave my blog, so when would you like to visit it?

Important Days of January 2023 : At All world Day, we have given the list of National and International Days of January 2023.

New Hope Physio a registered massage therapy clinic in Brampton. We provide complete relief from sports injuries, stress, anxiety and more.

I’ve been searching for hours on this topic and finally found your post. slotsite, I have read your post and I am very impressed. We prefer your opinion and will visit this site frequently to refer to your opinion. When would you like to visit my site?

I am very impressed with your writing casinosite I couldn’t think of this, but it’s amazing! I wrote several posts similar to this one, but please come and see!

Pug Puppies for Sale Near Me

pugs puppies for sale

teacup pugs for sale

pug puppies for sale by owner

pug puppies ohio

PUG PUPPY FOR SALE NEAR ME

PUG PUPPIES FOR SALE

pug puppies for sale in kentucky

Pug Puppies for Sale Under $500 Near Me

pug puppies for sale in texas

pug puppies for sale $200

pugs for sale near me under $500

pugs for sale under $400 near me

pugs for sale near me

puppies for sale near me under $500

pug puppies for sale under $1,000 near me

pug for sale

pug puppies for sale under $300

Brindle Pug

Pitbull Pug Mix

Pugs for sale cheap

Cheap pug

affordable pug puppies for sale near me

black pugs for sale near me

White Pugs for sale

pug dog for sale

free pug puppies

pug puppies for sale in my area

mn pug breeders

pug puppies indiana

pugs for sale michigan

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

PUG PUPPY ADOPTION

Pug puppies for sale

Pug puppies for sale near me

Pug puppies near me

Pug Puppies for Sale Under $500 Near Me

Cute Pug Puppies

Black pug puppies

Black pug puppies for sale

pug puppies for adoption

black pug puppies for sale near me

chihuahua pug mix puppies

how much is a pug puppy

teacup pug puppies

baby pug puppies

baby pug puppies for sale

pictures of pug puppies

pug puppies for sale in Ohio

pug puppies price

pug mix puppies

teacup pug puppies for sale

best food for pug puppy

newborn pug puppies

pug puppies craigslist

pug puppies for sale craigslist

adorable pug puppies

how much does a pug puppy cost

Pitbull pug mix puppies

pug pit mix puppy

pug puppies for sale $200

pug puppies for sale in NJ

Pug puppies for sale in Wisconsin

pug puppy cost

pug puppy food

royal canin pug puppy

royal canin pug puppy food

fawn pug puppy

pug puppies for sale florida

pug puppies for sale in Indiana

pug puppies for sale in KY

pug puppies for sale in NC

pug dog puppy

AKC Registered Pug Puppies For sale

cheap pug puppies for sale near me

cheap pug puppies for sale in California

cheap pug puppies for sale in nj

Black Pug Puppies for sale

pugs puppies for sale

They deliver the most excellent, expert services. This platform can be extremely helpful to students at all academic levels, hence the greatest services must be offered to all of them. College and university students should make the most of it and offer the finest services.

Got to know lots of info about crypto trading just sharing you must check out it will help a lot if you are looking for crypto trading info

Very good nice information Thanks for sharing best regards

(amzaccessories Binance Bitcoin Cryptocurrency Trading)

Got to know lots of info about crypto trading just sharing you must check out it will help a lot if you are looking for crypto trading info

Very good nice information Thanks for sharing best regards

(amztechnologies Bitcoin Binance Cryptocurrency Trading)

Financial independence is a need of women and every girl should go for this in india women’s are actively working in each filed like mining, farming even women are running every vehicles even tractors to make herself financial independent.

Your writing is perfect and complete. casino online However, I think it will be more wonderful if your post includes additional topics that I am thinking of. I have a lot of posts on my site similar to your topic. Would you like to visit once?

Looking at this article, I miss the time when I didn’t wear a mask. baccaratcommunity Hopefully this corona will end soon. My blog is a blog that mainly posts pictures of daily life before Corona and landscapes at that time. If you want to remember that time again, please visit us.

Pug pups for sale are utterly gorgeous, affectionate, and intelligent. Excellent pedigrees, gorgeous coats, finely formed ears, a tight, curled tail, outstanding faces, and a superb conformation like their parents are all present in these puppies. The parents are both in wonderful health and are kind and devoted family members. They will arrive fully registered with the AKC, with pedigree papers, and with a one-year health guarantee.

Pug Puppies for Sale Near Me

pugs puppies for sale

teacup pugs for sale

pug puppies for sale by owner

pug puppies ohio

PUG PUPPY FOR SALE NEAR ME

PUG PUPPIES FOR SALE

pug puppies for sale in kentucky

Pug Puppies for Sale Under $500 Near Me

pug puppies for sale in texas

pug puppies for sale $200

pugs for sale near me under $500

pugs for sale under $400 near me

pugs for sale near me

puppies for sale near me under $500

pug puppies for sale under $1,000 near me

pug for sale

pug puppies for sale under $300

Brindle Pug

Pitbull Pug Mix

Pugs for sale cheap

Cheap pug

affordable pug puppies for sale near me

black pugs for sale near me

White Pugs for sale

pug dog for sale

free pug puppies

pug puppies for sale in my area

mn pug breeders

pug puppies indiana

pugs for sale michigan

PUG PUPPY ADOPTION

Pug puppies for sale

Pug puppies for sale near me

Pug puppies near me

Pug Puppies for Sale Under $500 Near Me

Cute Pug Puppies

Black pug puppies

Black pug puppies for sale

pug puppies for adoption

black pug puppies for sale near me

chihuahua pug mix puppies

how much is a pug puppy

teacup pug puppies

baby pug puppies

pictures of pug puppies

pug puppies for sale in Ohio

pug puppies price

pug mix puppies

teacup pug puppies for sale

best food for pug puppy

newborn pug puppies

pug puppies craigslist

pug puppies for sale craigslist

adorable pug puppies

how much does a pug puppy cost

Pitbull pug mix puppies

pug pit mix puppy

pug puppies for sale $200

pug puppies for sale in NJ

Pug puppies for sale in Wisconsin

pug puppy cost

pug puppy food

royal canin pug puppy

royal canin pug puppy food

fawn pug puppy

pug puppies for sale florida

pug puppies for sale in Indiana

pug puppies for sale in KY

pug puppies for sale in NC

pug dog puppy

AKC Registered Pug Puppies For sale

cheap pug puppies for sale near me

cheap pug puppies for sale in California

cheap pug puppies for sale in nj

Black Pug Puppies for sale

pugs puppies for sale

I was looking for another article by chance and found your article bitcoincasino I am writing on this topic, so I think it will help a lot. I leave my blog address below. Please visit once.

You have even managed to make it understandable and easy to read.

I have been looking for articles on these topics for a long time. casinosite I don’t know how grateful you are for posting on this topic. Thank you for the numerous articles on this site, I will subscribe to those links in my bookmarks and visit them often. Have a nice day

https://www.gamja888.com/ – 바카라사이트,카지노사이트,카지노게임사이트,온라인바카라,온라인카지노,Gamja888

https://gamja888.com/ – 퀸즈슬롯

https://gamja888.com/ – 맥스카지노

https://gamja888.com/ – 비바카지노

https://gamja888.com/ – 카지노주소

https://gamja888.com/ – 바카라추천

https://gamja888.com/ – 온라인바카라게임

https://gamja888.com/ – 안전한 바카라사이트

https://gamja888.com/ – 바카라

https://gamja888.com/ – 카지노

https://gamja888.com/ – 퀸즈슬롯 카지노

https://gamja888.com/ – 바카라게임사이트

https://gamja888.com/onlinebaccarat/ – 온라인바카라

https://gamja888.com/millionclubcasino/ – 밀리언클럽카지노

https://gamja888.com/safecasinosite/ – 안전카지노사이트

https://gamja888.com/baccaratsiterecommendation/ – 바카라사이트추천

https://gamja888.com/ourcasino/ – 우리카지노계열

https://gamja888.com/slotmachine777/ – 슬롯머신777

https://gamja888.com/royalcasinosite/ – 로얄카지노사이트

https://gamja888.com/crazyslot/ – 크레이지슬롯

https://gamja888.com/onlineblackjack/ – 온라인블랙잭

https://gamja888.com/internetroulette/ – 인터넷룰렛

https://gamja888.com/casinoverificationsite/ – 카지노검증사이트

https://gamja888.com/safebaccaratsite/ – 안전바카라사이트

https://gamja888.com/mobilebaccarat/ – 모바일바카라

https://gamja888.com/howtowin-baccarat/ – 바카라 필승법

https://gamja888.com/meritcasino/ – 메리트카지노

https://gamja888.com/baccarat-howto/ – 바카라 노하우

youube.me

instagrme.com

youubbe.me

Instagrm.me

Instagrme.net

internetgame.me

instagrme.live

naverom.me

facebokom.me

https://www.instagrme.com/ – 바카라사이트,우리카지노,온라인바카라,카지노사이트,실시간바카라

https://instagrme.com/ – 퀸즈슬롯

https://instagrme.com/ – 바카라게임

https://instagrme.com/ – 카지노주소

https://instagrme.com/ – 온라인카지노

https://instagrme.com/ – 온라인카지노사이트

https://instagrme.com/ – 바카라게임사이트

https://instagrme.com/ – 실시간바카라사이트

https://instagrme.com/ – 바카라

https://instagrme.com/ – 카지노

https://instagrme.com/woori-casino/ – 우리카지노

https://instagrme.com/theking-casino/ – 더킹카지노

https://instagrme.com/sands-casino/ – 샌즈카지노

https://instagrme.com/yes-casino/ – 예스카지노

https://instagrme.com/coin-casino/ – 코인카지노

https://instagrme.com/thenine-casino/ – 더나인카지노

https://instagrme.com/thezone-casino/ – 더존카지노

https://instagrme.com/casino-site/ – 카지노사이트

https://instagrme.com/gold-casino/ – 골드카지노

https://instagrme.com/evolution-casino/ – 에볼루션카지노

https://instagrme.com/casino-slotgames/ – 카지노 슬롯게임

https://instagrme.com/baccarat/ – baccarat

https://instagrme.com/texas-holdem-poker/ – 텍사스 홀덤 포카

https://instagrme.com/blackjack/ – blackjack

youube.me

gamja888.com

youubbe.me

Instagrm.me

Instagrme.net

internetgame.me

instagrme.live

naverom.me

facebokom.me

https://www.youubbe.me/ – 카지노사이트,바카라사이트,슬롯사이트,온라인카지노,카지노주소

https://youubbe.me/ – 카지노검증사이트

https://youubbe.me/ – 안전한카지노사이트

https://youubbe.me/ – 슬롯카지노

https://youubbe.me/ – 바카라게임

https://youubbe.me/ – 카지노추천

https://youubbe.me/ – 비바카지노

https://youubbe.me/ – 퀸즈슬롯

https://youubbe.me/ – 카지노

https://youubbe.me/ – 바카라

https://youubbe.me/ – 안전한 바카라사이트

https://youubbe.me/ – 온라인슬롯

https://youubbe.me/casinosite/ – 카지노사이트

https://youubbe.me/baccarat/ – 바카라

https://youubbe.me/baccaratsite/ – 바카라사이트

https://youubbe.me/pharaoh-casino/ – 파라오카지노

https://youubbe.me/제왕카지노/ – 제왕카지노

https://youubbe.me/mgm카지노/ – mgm카지노

https://youubbe.me/theking-casino/ – 더킹카지노

https://youubbe.me/coin-casino/ – 코인카지노

https://youubbe.me/solaire-casino/ – 솔레어카지노

https://youubbe.me/casino-game/ – 카지노게임

https://youubbe.me/micro-gaming/ – 마이크로게이밍

https://youubbe.me/asia-gaming/ – 아시아게이밍

https://youubbe.me/taisan-gaming/ – 타이산게이밍

https://youubbe.me/oriental-game/ – 오리엔탈게임

https://youubbe.me/evolution-game/ – 에볼루션게임

https://youubbe.me/dragon-tiger/ – 드래곤타이거

https://youubbe.me/dream-gaming/ – 드림게이밍

https://youubbe.me/vivo-gaming/ – 비보게이밍

youube.me

gamja888.com

instagrme.com

Instagrm.me

Instagrme.net

internetgame.me

instagrme.live

naverom.me

facebokom.me

https://www.youube.me/ – 카지노사이트,바카라사이트,바카라게임사이트,온라인바카라,인터넷카지노

https://youube.me/ – 퀸즈슬롯

https://youube.me/ – 카지노주소

https://youube.me/ – 비바카지노

https://youube.me/ – 카지노추천

https://youube.me/ – 카지노게임

https://youube.me/ – 온라인카지노사이트

https://youube.me/ – 카지노

https://youube.me/ – 바카라

https://youube.me/ – 온라인카지노

https://youube.me/ – 카지노게임사이트

https://youube.me/sandscasinoaddress/ – 카지노검증사이트

https://youube.me/royalcasinoseries/ – 로얄카지노계열

https://youube.me/slotmachinesite/ – 슬롯머신사이트

https://youube.me/maxcasino/ – 맥스카지노

https://youube.me/baccaratgamesite/ – 바카라게임사이트

https://youube.me/casimbakorea-casino/ – 카심바코리아 카지노

https://youube.me/mobilecasino/ – 모바일카지노

https://youube.me/real-timebaccarat/ – 실시간바카라

https://youube.me/livecasino/ – 라이브카지노

https://youube.me/onlineslots/ – 온라인슬롯

https://youube.me/sandscasinoaddress/ – 바카라 이기는방법

https://youube.me/safecasinosite/ – 안전카지노사이트

https://youube.me/ourcasinosite/ – 우리카지노사이트

https://youube.me/sandscasinoaddress/ – 샌즈카지노주소

https://youube.me/baccarat-rulesofthegame/ – 바카라 게임규칙

https://youube.me/baccarat-howtoplay/ – 바카라 게임방법

gamja888.com

instagrme.com

youubbe.me

Instagrm.me

Instagrme.net

internetgame.me

instagrme.live

naverom.me

facebokom.me

Coin Master is a slot game. which is available on both iOS and Android. It is a free game, but the coin you spend in the game. It can get free by completing levels or watching videos. Another way to get free coins is by avoiding the ads. just check this site’s coin master.

I came to this site with the introduction of a friend around me and I was very impressed when I found your writing. I’ll come back often after bookmarking! baccarat online

I’ve been troubled for several days with this topic. totosite, But by chance looking at your post solved my problem! I will leave my blog, so when would you like to visit it?

Very realy and informative content.

AC tractor

Very informative and I learned so many thinks by your blog.

Tractor Price

thx you for comment at webslot nt88 webslot online nt88 slot the best 2022

give and bet slot mony for true clik link in and follow me noww

gamesexy slot

game sa slot

game ebet slot

game pp slot

game pg slot

สล็อตแตกง่าย

game sg slot

game jili slot

game joker slot

game slot bbin

equestrian supplies including horse rugs, riding boots and everything else for the horse and rider.

horse shops near me

I would say that every successful person should properly manage their finances, and every business should clearly control the flow of money. In the article https://www.subbly.co/blog/subscription-billing-a-complete-guide-for-merchants/ I found great solutions and ideas on billing systems that should work

Amazing post with meaningful content.

Powertrac tractor