Last Updated on March 21, 2019 by NandiNN

How to Organize Your Finances

Being an entrepreneur means you get to know more about investing, organizing and saving funds for your business, which will help in the long run. In other words, learn how to manage your personal finances.

Whatever business you run, it is important that you stay on top of your finances and be in control of your own money, to aid the survival of your business.

While it is easy to think entrepreneurs have the upper hand in handling finances effectively, it could also be the other way round, and some tend to lose out.

A lot of entrepreneurs make the mistake of tying their personal finances closely with their business return or running both in a terrible way that eventually affects their financial life.

There needs to be a balance to avoid running into a debt that could have been avoided.

One of the significant differences between successful women entrepreneurs and unsuccessful ones are in how they manage their finances.

But before we get started on the best tips on how to manage your personal finances, we would love for you to join our growing Facebook group right here! Be sure to follow us on Instagram too!

We also wanted to take the opportunity to let you know that we use Affiliate links on some of our blog posts. This means that we could make a commission if you click on an affiliate link and purchase something. Please check out our full disclaimer and policy page here.

What Are Good Money Management Skills?

Financial specialists suggest that you save money regularly which is good practice when it comes to finding a way to manage your personal finance.

But despite the constant recommendations and news on saving and investing, a lot of people still find it difficult to have a successful financial record.

As an entrepreneur this is, in fact, necessary if you do not want to continue living from paycheck to paycheck and on consolidating debt.

Why is Money Management Skills Important?

As someone that runs a business or is an entrepreneur, it is crucial that you understand how to manage your money and income. This alone can cause so much stress if something goes wrong.

By having a budget that allows you to live comfortably and also having consistent cash flow in your business, means you will be set up for success much sooner than you think.

We are going to share basic money management skills you need as an entrepreneur to succeed.

Tips for Managing your Money

If you are looking for great tips for managing your money, this guide should help you. We have rounded up six amazing tips below that will help you to start to manage your personal finances as an entrepreneur.

1// Keep your expenses below your income

A lot of people believe that with more income, there will be more room to save and expenses will automatically stay below their income.

On the contrary, this is not always true, as there are cases where people get financially tight just a few months after they got a raise.

This is simply because expenses are bound to rise as your income does. You have to intentionally learn to keep your costs below your income no matter what.

If you keep a budget for your business, then your finances should also not be left out. Make it a conscious effort to work around a budget, so you can always have some spare money left that can be saved or put into proper use.

2// Protect your most valuable asset

The most valuable asset of an entrepreneur is the ability to make money and increase your income, but how well do they protect it?

A lot of people wave the idea of insurance off because they feel no form of danger can come their way.

Of course, no one ever wishes for that, but think about what will happen if you, by chance, lose your source of income.

Is your most valuable asset protected? You should look into disability insurance that will provide income when you are, by any chance, unable to perform your work.

3// Diversify your income

Having different income streams is one of the best advice you can explore as an entrepreneur.

It doesn’t matter if you have great clients or if your business seems to be booming. Diversity will give you options, and if for some reason, one of your options slow down, another will pick you back up.

You might want to take a look at these 17 passive income ideas to increase your income and make extra cash.

Entrepreneurship isn’t always a bed of roses, and you have a higher risk of failure than of success.

That is the bitter truth no one wants to talk about but will have to deal with.

How about you try hands on one or two side business, to help even out your income. Ideally you want them to bringing at least a minimal amount of cash flow.

They will eventually become something to fall back on in downtime.

Also, consider alternative investments like Lending Club and taking your savings seriously. No one prays for a business to fail but you need to have a backup plan prepared.

4// Paying off existing debt

If you truly want to be financially successful, you need to work on paying off existing debt.

It is, of course, not interesting when you have to spend recently hard-earned money on past expenses, but you have to. As you work towards managing your income, make sure you do not leave the debts untouched, especially if you are looking to obtain even more valuable possessions.

You surely won’t want to live with deft forever.

You can make use of https://debtreviews.com/ to manage your debts or seek out the services of an expert debt counselor if it seems to be getting out of hand.

5// Considering cost effectiveness

Cost effectiveness is one of the major things entrepreneurs consider in their business, but how many of them apply this in their personal finance lives?

While managing your personal finances, ensure you constantly look at how cost effective your expenses are.

Look at the benefits and see how spending on these things will help you and not just burn out your money, without making much impact.

Call quits on projects and purchases with fewer benefits than costs and go for more beneficial ones.

Looking and considering cost effectiveness is one of the best things you can for yourself and your business.

6// Seek out professional tax advice

If you like to take your personal finances seriously, then you may need to consider seeking out professional tax advice.

It is important that you are fully aware of how tax payments work and how it affects your income and expenses. This will help you avoid getting into trouble or looking completely clueless.

Get a professional who is familiar with small businesses and entrepreneurs, to get the best experience.

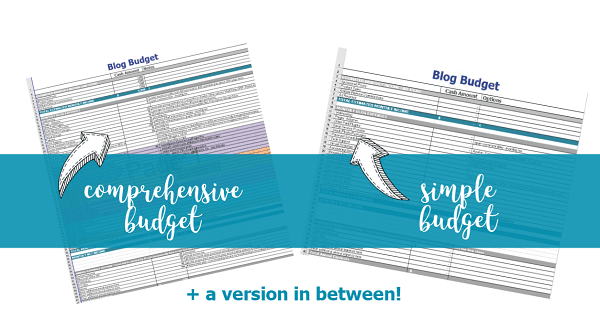

Grab your Blog Budget Spreadsheet

Are you losing money or making money with your blog? This blog budget should help you determine that.

Conclusion

To be a successful entrepreneur, you need to strike a balance between your personal finances and your business finances.

These tips explained above will help you look into your personal finance and work your way around it, to ensure that there is a balance and that you do not run into unending debts.

Be smart about your finances, know where to invest, set aside your savings, and work towards financial freedom.

Do you have more tips on how to manage your personal finances as an entrepreneur? Please share them below.

Author bio:

With over 10 years in the financial vertical, focusing mainly on debt, Kevin Tomlinson is an experienced

writer with the best tips and tricks for dealing with the debt of any sort. Kevin works best with debt

settlement, Debt Consolidation, Tax Debt Relief and Student Loan Debt.

If you are looking for extra ways to make money, find them here!

If you enjoyed our blog we would like to have you join our email list and receive weekly money-making tips, you can join now! Don’t forget to like the Facebook page. The page is created to share your work, pitch your services and learn from other experienced bloggers!

***We would like to note that this post and most posts on our blog may contain affiliate links. This means that if you purchase something that has an affiliate link, we will get a commission from it. Not all items recommended on our site are affiliate links. We only recommend items that we have used and tried. These items have brought us much success and we highly recommend them to you in order to be successful. Thank you for your trust!

In account answer manner, we would unhesitatingly say that you ought to consider College Paper World to help you with your accounting assignments. You start by taking care of in the request structure, which expects you to fill in unambiguous subtleties and guidelines about the request.

Your article has answered the question I was wondering about! I would like to write a thesis on this subject, but I would like you to give your opinion once 😀 totosite

SexyPG1688 king123เว็บออนไลน์ที่ให้ได้มากกว่า

Feeling diasporic due to the shift in online classes? Need some help with my online class? We have got your back! At mbadissertationhelp.co.uk, you can get all sorts of academic help that you can possibly imagine!

Nice article thanks for sharing this useful information with us

Excellent ! I personally like your blog and waiting for more articles like this

Pug Puppies for Sale Near Me

pugs puppies for sale

teacup pugs for sale

pug puppies for sale by owner

pug puppies ohio

PUG PUPPY FOR SALE NEAR ME

PUG PUPPIES FOR SALE

pug puppies for sale in kentucky

Pug Puppies for Sale Under $500 Near Me

pug puppies for sale in texas

pug puppies for sale $200

pugs for sale near me under $500

pugs for sale under $400 near me

pugs for sale near me

puppies for sale near me under $500

pug puppies for sale under $1,000 near me

pug for sale

pug puppies for sale under $300

Brindle Pug

Pitbull Pug Mix

Pugs for sale cheap

Cheap pug

affordable pug puppies for sale near me

black pugs for sale near me

White Pugs for sale

pug dog for sale

free pug puppies

pug puppies for sale in my area

mn pug breeders

pug puppies indiana

pugs for sale michigan

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

PUG PUPPY ADOPTION

Pug puppies for sale

Pug puppies for sale near me

Pug puppies near me

Pug Puppies for Sale Under $500 Near Me

Cute Pug Puppies

Black pug puppies

Black pug puppies for sale

pug puppies for adoption

black pug puppies for sale near me

chihuahua pug mix puppies

how much is a pug puppy

teacup pug puppies

baby pug puppies

baby pug puppies for sale

pictures of pug puppies

pug puppies for sale in Ohio

pug puppies price

pug mix puppies

teacup pug puppies for sale

best food for pug puppy

newborn pug puppies

pug puppies craigslist

pug puppies for sale craigslist

adorable pug puppies

how much does a pug puppy cost

Pitbull pug mix puppies

pug pit mix puppy

pug puppies for sale $200

pug puppies for sale in NJ

Pug puppies for sale in Wisconsin

pug puppy cost

pug puppy food

royal canin pug puppy

royal canin pug puppy food

fawn pug puppy

pug puppies for sale florida

pug puppies for sale in Indiana

pug puppies for sale in KY

pug puppies for sale in NC

pug dog puppy

AKC Registered Pug Puppies For sale

cheap pug puppies for sale near me

cheap pug puppies for sale in California

cheap pug puppies for sale in nj

Black Pug Puppies for sale

pugs puppies for sale

Pug Puppies for Sale Near Me

pugs puppies for sale

teacup pugs for sale

pug puppies for sale by owner

pug puppies ohio

PUG PUPPY FOR SALE NEAR ME

PUG PUPPIES FOR SALE

pug puppies for sale in kentucky

Pug Puppies for Sale Under $500 Near Me

pug puppies for sale in texas

pug puppies for sale $200

pugs for sale near me under $500

pugs for sale under $400 near me

pugs for sale near me

puppies for sale near me under $500

pug puppies for sale under $1,000 near me

pug for sale

pug puppies for sale under $300

Brindle Pug

Pitbull Pug Mix

Pugs for sale cheap

Cheap pug

affordable pug puppies for sale near me

black pugs for sale near me

White Pugs for sale

pug dog for sale

free pug puppies

pug puppies for sale in my area

mn pug breeders

pug puppies indiana

pugs for sale michigan

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

PUG PUPPY ADOPTION

Pug puppies for sale

Pug puppies for sale near me

Pug puppies near me

Pug Puppies for Sale Under $500 Near Me

Cute Pug Puppies

Black pug puppies

Black pug puppies for sale

pug puppies for adoption

black pug puppies for sale near me

chihuahua pug mix puppies

how much is a pug puppy

teacup pug puppies

baby pug puppies

baby pug puppies for sale

pictures of pug puppies

pug puppies for sale in Ohio

pug puppies price

pug mix puppies

teacup pug puppies for sale

best food for pug puppy

newborn pug puppies

pug puppies craigslist

pug puppies for sale craigslist

adorable pug puppies

how much does a pug puppy cost

Pitbull pug mix puppies

pug pit mix puppy

pug puppies for sale $200

pug puppies for sale in NJ

Pug puppies for sale in Wisconsin

pug puppy cost

pug puppy food

royal canin pug puppy

royal canin pug puppy food

fawn pug puppy

pug puppies for sale florida

pug puppies for sale in Indiana

pug puppies for sale in KY

pug puppies for sale in NC

pug dog puppy

AKC Registered Pug Puppies For sale

cheap pug puppies for sale near me

cheap pug puppies for sale in California

cheap pug puppies for sale in nj

Black Pug Puppies for sale

pugs puppies for sale

Pug Puppies for Sale Near Me

pugs puppies for sale

teacup pugs for sale

pug puppies for sale by owner

pug puppies ohio

PUG PUPPY FOR SALE NEAR ME

PUG PUPPIES FOR SALE

pug puppies for sale in kentucky

Pug Puppies for Sale Under $500 Near Me

pug puppies for sale in texas

pug puppies for sale $200

pugs for sale near me under $500

pugs for sale under $400 near me

pugs for sale near me

puppies for sale near me under $500

pug puppies for sale under $1,000 near me

pug for sale

pug puppies for sale under $300

Brindle Pug

Pitbull Pug Mix

Pugs for sale cheap

Cheap pug

affordable pug puppies for sale near me

black pugs for sale near me

White Pugs for sale

pug dog for sale

free pug puppies

pug puppies for sale in my area

mn pug breeders

pug puppies indiana

pugs for sale michigan

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

PUG PUPPY ADOPTION

Pug puppies for sale

Pug puppies for sale near me

Pug puppies near me

Pug Puppies for Sale Under $500 Near Me

Cute Pug Puppies

Black pug puppies

Black pug puppies for sale

pug puppies for adoption

black pug puppies for sale near me

chihuahua pug mix puppies

how much is a pug puppy

teacup pug puppies

baby pug puppies

baby pug puppies for sale

pictures of pug puppies

pug puppies for sale in Ohio

pug puppies price

pug mix puppies

teacup pug puppies for sale

best food for pug puppy

newborn pug puppies

pug puppies craigslist

pug puppies for sale craigslist

adorable pug puppies

how much does a pug puppy cost

Pitbull pug mix puppies

pug pit mix puppy

pug puppies for sale $200

pug puppies for sale in NJ

Pug puppies for sale in Wisconsin

pug puppy cost

pug puppy food

royal canin pug puppy

royal canin pug puppy food

fawn pug puppy

pug puppies for sale florida

pug puppies for sale in Indiana

pug puppies for sale in KY

pug puppies for sale in NC

pug dog puppy

AKC Registered Pug Puppies For sale

cheap pug puppies for sale near me

cheap pug puppies for sale in California

cheap pug puppies for sale in nj

Black Pug Puppies for sale

pugs puppies for sale

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

Very good article, give me a lot of good information. Please continue to share more as a blog. I have now saved it to my bookmarks so I can keep in touch with you.

Thanks for sharing this nice blog. And thanks for the information. Will like to read more from this blog.

Comprare Patente di Guida

Comprare Patente B

Comprare Patente C

Comprare Patente CQC

Acquista una patente di guida senza esami

Führerschein

FÜHRERSCHEIN ONLINE KAUFEN

fuhrerschein-kaufen

Mpu kaufen, legal & ohne Prüfung

I am grateful that you have provided such helpful information. I haven’t been able to think of very many questions pertaining to this subject for some time. I’m going to stand by your side!

Thanks so much for sharing this great information! I look forward to seeing more of your posts as soon as possible!

Pug pups for sale are utterly gorgeous, affectionate, and intelligent. Excellent pedigrees, gorgeous coats, finely formed ears, a tight, curled tail, outstanding faces, and a superb conformation like their parents are all present in these puppies. The parents are both in wonderful health and are kind and devoted family members. They will arrive fully registered with the AKC, with pedigree papers, and with a one-year health guarantee.

Pug Puppies for Sale Near Me

pugs puppies for sale

teacup pugs for sale

pug puppies for sale by owner

pug puppies ohio

PUG PUPPY FOR SALE NEAR ME

PUG PUPPIES FOR SALE

pug puppies for sale in kentucky

Pug Puppies for Sale Under $500 Near Me

pug puppies for sale in texas

pug puppies for sale $200

pugs for sale near me under $500

pugs for sale under $400 near me

pugs for sale near me

puppies for sale near me under $500

pug puppies for sale under $1,000 near me

pug for sale

pug puppies for sale under $300

Brindle Pug

Pitbull Pug Mix

Pugs for sale cheap

Cheap pug

affordable pug puppies for sale near me

black pugs for sale near me

White Pugs for sale

pug dog for sale

free pug puppies

pug puppies for sale in my area

mn pug breeders

pug puppies indiana

pugs for sale michigan

PUG PUPPY ADOPTION

Pug puppies for sale

Pug puppies for sale near me

Pug puppies near me

Pug Puppies for Sale Under $500 Near Me

Cute Pug Puppies

Black pug puppies

Black pug puppies for sale

pug puppies for adoption

black pug puppies for sale near me

chihuahua pug mix puppies

how much is a pug puppy

teacup pug puppies

baby pug puppies

pictures of pug puppies

pug puppies for sale in Ohio

pug puppies price

pug mix puppies

teacup pug puppies for sale

best food for pug puppy

newborn pug puppies

pug puppies craigslist

pug puppies for sale craigslist

adorable pug puppies

how much does a pug puppy cost

Pitbull pug mix puppies

pug pit mix puppy

pug puppies for sale $200

pug puppies for sale in NJ

Pug puppies for sale in Wisconsin

pug puppy cost

pug puppy food

royal canin pug puppy

royal canin pug puppy food

fawn pug puppy

pug puppies for sale florida

pug puppies for sale in Indiana

pug puppies for sale in KY

pug puppies for sale in NC

pug dog puppy

AKC Registered Pug Puppies For sale

cheap pug puppies for sale near me

cheap pug puppies for sale in California

cheap pug puppies for sale in nj

Black Pug Puppies for sale

pugs puppies for sale

Pleasant to meet you, Jerry Henry here. I’m a student at college. The perfect online dissertation help service for my assignment job was discovered today. Another thing I’ve noticed is the caliber of your writing. I enjoy reading your writing. How to Manage Your Personal Finances as an Entrepreneur is something you discuss. I kept reading your article as well. I appreciate you sharing with us.

This is such a great resource that you are providing and you give it away for free. I love seeing blog that understand the value of providing a quality resource for free

https://www.gamja888.com/ – 바카라사이트,카지노사이트,카지노게임사이트,온라인바카라,온라인카지노,Gamja888

https://gamja888.com/ – 퀸즈슬롯

https://gamja888.com/ – 맥스카지노

https://gamja888.com/ – 비바카지노

https://gamja888.com/ – 카지노주소

https://gamja888.com/ – 바카라추천

https://gamja888.com/ – 온라인바카라게임

https://gamja888.com/ – 안전한 바카라사이트

https://gamja888.com/ – 바카라

https://gamja888.com/ – 카지노

https://gamja888.com/ – 퀸즈슬롯 카지노

https://gamja888.com/ – 바카라게임사이트

https://gamja888.com/onlinebaccarat/ – 온라인바카라

https://gamja888.com/millionclubcasino/ – 밀리언클럽카지노

https://gamja888.com/safecasinosite/ – 안전카지노사이트

https://gamja888.com/baccaratsiterecommendation/ – 바카라사이트추천

https://gamja888.com/ourcasino/ – 우리카지노계열

https://gamja888.com/slotmachine777/ – 슬롯머신777

https://gamja888.com/royalcasinosite/ – 로얄카지노사이트

https://gamja888.com/crazyslot/ – 크레이지슬롯

https://gamja888.com/onlineblackjack/ – 온라인블랙잭

https://gamja888.com/internetroulette/ – 인터넷룰렛

https://gamja888.com/casinoverificationsite/ – 카지노검증사이트

https://gamja888.com/safebaccaratsite/ – 안전바카라사이트

https://gamja888.com/mobilebaccarat/ – 모바일바카라

https://gamja888.com/howtowin-baccarat/ – 바카라 필승법

https://gamja888.com/meritcasino/ – 메리트카지노

https://gamja888.com/baccarat-howto/ – 바카라 노하우

youube.me

instagrme.com

youubbe.me

Instagrm.me

Instagrme.net

internetgame.me

instagrme.live

naverom.me

facebokom.me

https://www.instagrme.com/ – 바카라사이트,우리카지노,온라인바카라,카지노사이트,실시간바카라

https://instagrme.com/ – 퀸즈슬롯

https://instagrme.com/ – 바카라게임

https://instagrme.com/ – 카지노주소

https://instagrme.com/ – 온라인카지노

https://instagrme.com/ – 온라인카지노사이트

https://instagrme.com/ – 바카라게임사이트

https://instagrme.com/ – 실시간바카라사이트

https://instagrme.com/ – 바카라

https://instagrme.com/ – 카지노

https://instagrme.com/woori-casino/ – 우리카지노

https://instagrme.com/theking-casino/ – 더킹카지노

https://instagrme.com/sands-casino/ – 샌즈카지노

https://instagrme.com/yes-casino/ – 예스카지노

https://instagrme.com/coin-casino/ – 코인카지노

https://instagrme.com/thenine-casino/ – 더나인카지노

https://instagrme.com/thezone-casino/ – 더존카지노

https://instagrme.com/casino-site/ – 카지노사이트

https://instagrme.com/gold-casino/ – 골드카지노

https://instagrme.com/evolution-casino/ – 에볼루션카지노

https://instagrme.com/casino-slotgames/ – 카지노 슬롯게임

https://instagrme.com/baccarat/ – baccarat

https://instagrme.com/texas-holdem-poker/ – 텍사스 홀덤 포카

https://instagrme.com/blackjack/ – blackjack

youube.me

gamja888.com

youubbe.me

Instagrm.me

Instagrme.net

internetgame.me

instagrme.live

naverom.me

facebokom.me

https://www.youubbe.me/ – 카지노사이트,바카라사이트,슬롯사이트,온라인카지노,카지노주소

https://youubbe.me/ – 카지노검증사이트

https://youubbe.me/ – 안전한카지노사이트

https://youubbe.me/ – 슬롯카지노

https://youubbe.me/ – 바카라게임

https://youubbe.me/ – 카지노추천

https://youubbe.me/ – 비바카지노

https://youubbe.me/ – 퀸즈슬롯

https://youubbe.me/ – 카지노

https://youubbe.me/ – 바카라

https://youubbe.me/ – 안전한 바카라사이트

https://youubbe.me/ – 온라인슬롯

https://youubbe.me/casinosite/ – 카지노사이트

https://youubbe.me/baccarat/ – 바카라

https://youubbe.me/baccaratsite/ – 바카라사이트

https://youubbe.me/pharaoh-casino/ – 파라오카지노

https://youubbe.me/제왕카지노/ – 제왕카지노

https://youubbe.me/mgm카지노/ – mgm카지노

https://youubbe.me/theking-casino/ – 더킹카지노

https://youubbe.me/coin-casino/ – 코인카지노

https://youubbe.me/solaire-casino/ – 솔레어카지노

https://youubbe.me/casino-game/ – 카지노게임

https://youubbe.me/micro-gaming/ – 마이크로게이밍

https://youubbe.me/asia-gaming/ – 아시아게이밍

https://youubbe.me/taisan-gaming/ – 타이산게이밍

https://youubbe.me/oriental-game/ – 오리엔탈게임

https://youubbe.me/evolution-game/ – 에볼루션게임

https://youubbe.me/dragon-tiger/ – 드래곤타이거

https://youubbe.me/dream-gaming/ – 드림게이밍

https://youubbe.me/vivo-gaming/ – 비보게이밍

youube.me

gamja888.com

instagrme.com

Instagrm.me

Instagrme.net

internetgame.me

instagrme.live

naverom.me

facebokom.me

https://www.youube.me/ – 카지노사이트,바카라사이트,바카라게임사이트,온라인바카라,인터넷카지노

https://youube.me/ – 퀸즈슬롯

https://youube.me/ – 카지노주소

https://youube.me/ – 비바카지노

https://youube.me/ – 카지노추천

https://youube.me/ – 카지노게임

https://youube.me/ – 온라인카지노사이트

https://youube.me/ – 카지노

https://youube.me/ – 바카라

https://youube.me/ – 온라인카지노

https://youube.me/ – 카지노게임사이트

https://youube.me/sandscasinoaddress/ – 카지노검증사이트

https://youube.me/royalcasinoseries/ – 로얄카지노계열

https://youube.me/slotmachinesite/ – 슬롯머신사이트

https://youube.me/maxcasino/ – 맥스카지노

https://youube.me/baccaratgamesite/ – 바카라게임사이트

https://youube.me/casimbakorea-casino/ – 카심바코리아 카지노

https://youube.me/mobilecasino/ – 모바일카지노

https://youube.me/real-timebaccarat/ – 실시간바카라

https://youube.me/livecasino/ – 라이브카지노

https://youube.me/onlineslots/ – 온라인슬롯

https://youube.me/sandscasinoaddress/ – 바카라 이기는방법

https://youube.me/safecasinosite/ – 안전카지노사이트

https://youube.me/ourcasinosite/ – 우리카지노사이트

https://youube.me/sandscasinoaddress/ – 샌즈카지노주소

https://youube.me/baccarat-rulesofthegame/ – 바카라 게임규칙

https://youube.me/baccarat-howtoplay/ – 바카라 게임방법

gamja888.com

instagrme.com

youubbe.me

Instagrm.me

Instagrme.net

internetgame.me

instagrme.live

naverom.me

facebokom.me

바카라사이트

카지노사이트

카지노게임사이트

온라인카지노

퀸즈슬롯

맥스카지노

비바카지노

카지노주소

바카라추천

온라인바카라게임

안전한 바카라사이트

바카라

카지노

퀸즈슬롯 카지노

바카라게임사이트

온라인바카라

밀리언클럽카지노

안전카지노사이트

바카라사이트추천

우리카지노계열

슬롯머신777

로얄카지노사이트

크레이지슬롯

온라인블랙잭

인터넷룰렛

카지노검증사이트

안전바카라사이트

모바일바카라

바카라 필승법

메리트카지노

바카라 노하우

바카라사이트

온라인카지노

카지노사이트

카지노게임사이트

퀸즈슬롯

맥스카지노

비바카지노

카지노주소

바카라추천

온라인바카라게임

안전한 바카라사이트

바카라

카지노

퀸즈슬롯 카지노

바카라게임사이트

온라인바카라

밀리언클럽카지노

안전카지노사이트

바카라사이트추천

우리카지노계열

슬롯머신777

로얄카지노사이트

크레이지슬롯

온라인블랙잭

인터넷룰렛

카지노검증사이트

안전바카라사이트

모바일바카라

바카라 필승법

메리트카지노

바카라 노하우

https://youube.me/

https://instagrme.com/

https://youubbe.me/

https://Instagrm.me/

https://Instagrme.net/

https://internetgame.me/

https://instagrme.live/

https://naverom.me

https://facebokom.me

바카라사이트

온라인바카라

실시간바카라

퀸즈슬롯

바카라게임

카지노주소

온라인카지노

온라인카지노사이트

바카라게임사이트

실시간바카라사이트

바카라

카지노

우리카지노

더킹카지노

샌즈카지노

예스카지노

코인카지노

더나인카지노

더존카지노

카지노사이트

골드카지노

에볼루션카지노

카지노 슬롯게임

baccarat

텍사스 홀덤 포카

blackjack

바카라사이트

온라인바카라

실시간바카라

퀸즈슬롯

바카라게임

카지노주소

온라인카지노

온라인카지노사이트

바카라게임사이트

실시간바카라사이트

바카라

카지노

우리카지노

더킹카지노

샌즈카지노

예스카지노

코인카지노

더나인카지노

더존카지노

카지노사이트

골드카지노

에볼루션카지노

카지노 슬롯게임

baccarat

텍사스 홀덤 포카

blackjack

https://youube.me/

https://gamja888.com/

https://youubbe.me/

https://Instagrm.me/

https://Instagrme.net/

https://internetgame.me/

https://instagrme.live/

https://naverom.me

https://facebokom.me

카지노사이트

슬롯사이트

온라인카지노

카지노주소

카지노검증사이트

안전한카지노사이트

슬롯카지노

바카라게임

카지노추천

비바카지노

퀸즈슬롯

카지노

바카라

안전한 바카라사이트

온라인슬롯

카지노사이트

바카라

바카라사이트

파라오카지노

제왕카지노

mgm카지노

더킹카지노

코인카지노

솔레어카지노

카지노게임

마이크로게이밍

아시아게이밍

타이산게이밍

오리엔탈게임

에볼루션게임

드래곤타이거

드림게이밍

비보게이밍

카지노사이트

슬롯사이트

온라인카지노

카지노주소

카지노검증사이트

안전한카지노사이트

슬롯카지노

바카라게임

카지노추천

비바카지노

퀸즈슬롯

카지노

바카라

안전한 바카라사이트

온라인슬롯

카지노사이트

바카라

바카라사이트

파라오카지노

제왕카지노

mgm카지노

더킹카지노

코인카지노

솔레어카지노

카지노게임

마이크로게이밍

아시아게이밍

타이산게이밍

오리엔탈게임

에볼루션게임

드래곤타이거

드림게이밍

비보게이밍

https://youube.me/

https://gamja888.com/

https://instagrme.com/

https://Instagrm.me/

https://Instagrme.net/

https://internetgame.me/

https://instagrme.live/

https://naverom.me

https://facebokom.me

온라인바카라

카지노사이트

바카라사이트

인터넷카지노

바카라게임사이트

퀸즈슬롯

카지노주소

비바카지노

카지노추천

카지노게임

온라인카지노사이트

카지노

바카라

온라인카지노

카지노게임사이트

카지노검증사이트

로얄카지노계열

슬롯머신사이트

맥스카지노

바카라게임사이트

카심바코리아 카지노

모바일카지노

실시간바카라

라이브카지노

온라인슬롯

바카라 이기는방법

안전카지노사이트

우리카지노사이트

샌즈카지노주소

바카라 게임규칙

바카라 게임방법

온라인바카라

카지노사이트

바카라사이트

인터넷카지노

바카라게임사이트

퀸즈슬롯

카지노주소

비바카지노

카지노추천

카지노게임

온라인카지노사이트

카지노

바카라

온라인카지노

카지노게임사이트

카지노검증사이트

로얄카지노계열

슬롯머신사이트

맥스카지노

바카라게임사이트

카심바코리아 카지노

모바일카지노

실시간바카라

라이브카지노

온라인슬롯

바카라 이기는방법

안전카지노사이트

우리카지노사이트

샌즈카지노주소

바카라 게임규칙

바카라 게임방법

https://gamja888.com/

https://instagrme.com/

https://youubbe.me/

https://Instagrm.me/

https://Instagrme.net/

https://internetgame.me/

https://instagrme.live/

https://naverom.me

https://facebokom.me

Its a fantastic blog, and it provides such a relevant information.

Second hand tractor

Why don’t you try your hand at a side business or two to help balance out your primary source of income? In a perfect world, you want them to dordle bring in some level of cash flow, even if it’s just a little bit.

Your content is very good and the posts that you share are also very good. Thank you!

Amazing, Such a more valuable information. Thank you !!

These are great things to think about, thank you for sharing such a great informative posts.

This is a technical content, It is educative post.

I really enjoy every blog here tremendous !!!!

thank you highly appreciated content will visit again for more information like this

feel free to visit my page for any sort of designing

Creative Agency

Social Media Marketing Company

web Development Company Karachi

Web Design Services

Awww I am glad you like these personal finance tips on managing your money. Good luck and let us know how it goes!

I am glad you like the tips Amy.

They are so many ways to manage your personal finances but this is a good place to start.

These are great things to think about, thank you for sharing.

great advice. This year that is my goal as well. I am tired of my financial hardships.