Last Updated on January 3, 2021 by NandiNN

What should you have: financial plan vs budget?

Knowing the difference between a “spending plan vs budget” is crucial to the success of your finances in the long run.

The first step you need to take before you create a spending plan or a budget is to know exactly where you stand right now financially.

In our last post about finances, I went into great detail about ways to get everything you need in order to properly evaluate where you stand financially.

It’s essential that you have the big picture of what you owe, what you have, and your overall financial situation.

This is extremely important if your goal is to better have control of your money.

Today, I really want to focus on some of the best tips you can use for setting up a spending plan or creating a budget that works.

Spending Plan vs Budget – which one will you go with to ensure your money is better managed?

So what is a spending plan anyway?

Before we get into that, I want you to work on an overall financial plan that will protect you no matter your circumstances.

If your goal is to become financially free and learn more about how to successfully make sense of your income, join our 30 Money Challenge where we will share actionable tips you can use to succeed with money.

You can go ahead and sign up right here for the full details.

If you are ready to learn more about:

-

The benefits of creating a spending plan

-

Setting up a spending plan that works

-

And a spending plan example

Then let’s get into it now.

Before we look more into spending plan vs budget, we did want you to follow us on Facebook for more awesome ideas on saving or making more money. You can also follow us on Instagram for more tips.

We also wanted to take the opportunity to let you know that we use Affiliate links on some of our blog posts. This means that we could make a commission if you click on an affiliate link and purchase something.

What is the difference between a spending plan and a budget?

To keep it simple, a spending plan is simply a money-management way of spending money if absolutely necessary and then saving the rest.

A spending plan is a helpful way to track your monthly budget as well.

It allows you to choose what you absolutely must spend money on each month (for example essentials), and it gives you the freedom to spend money on whatever you want out of the balance.

Let’s say you were making $3000 a month.

Out of that $3000, half of that would go to ensure your essentials are paid, your bills and credit cards are paid.

And anything remaining is yours to spend how you wish.

Whereas a budget requires you to stick to what you assigned that dollar figure to.

It’s a fancier way of budgeting without all the restrictions that come with budgeting.

![]()

Creating A Spending Plan

Spending plans are super simple to set up.

What you need to know is how much you have coming in, minus your must-have living expenses such as shelter, food, health care, clothing, and business or work needs.

For example, if you work online from home, your car would typically fall under a want and not a need.

But if you have to have the car to get to and from work, or you have to use it for health care, or even to simply do groceries, then this car is now considered a need.

Once you know what you have left after meeting basic needs, you can now use the money you have to help you set up savings, pay off credit card debt, start a new business, or meet other life goals you have, such as learning to ballroom dance.

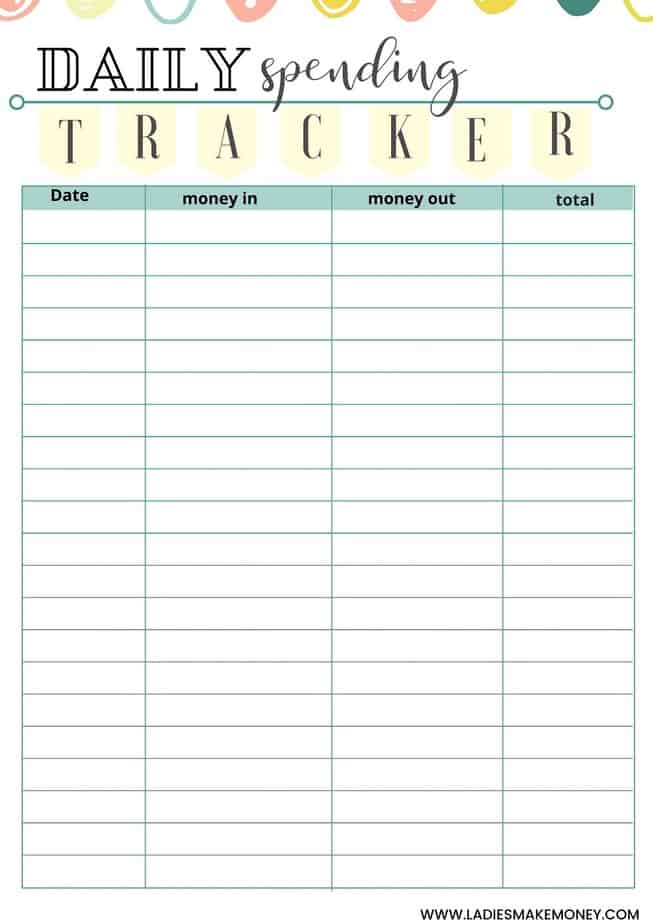

I would suggest grabbing your very own FREE spending tracker today.

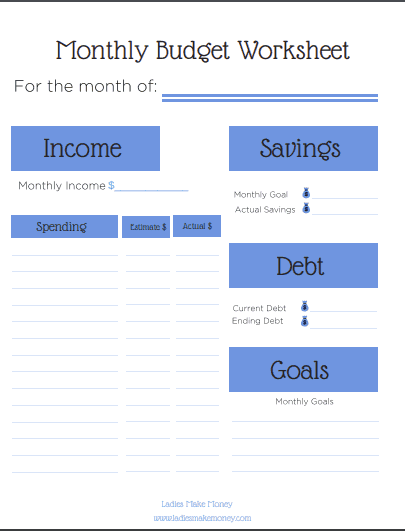

Setting Up Your Budget for beginners

Setting Up Your Budget for beginners

A budget is basically a plan you create for yourself which details out exactly how you will spend your money from month to month.

To set up a budget, you need to really know how much you make vs how much you spend each month to survive.

The most recommended budget system by most financial people is going with the 50/20/30 rule or plan.

If you are a beginner and you have no idea where to start, I suggest reading these two posts:

- The benefit of budgeting your money so you become financially free

- The best budget planner for beginners to help you better budget

If you are going to start a budget, I really recommend you go with the 50/20/30 budgeting rule.

You start the same as you would if you went with a spending plan, list all your income and your expenses, including your wants, needs, and responsibilities, all in one big spreadsheet separated by their categories: Needs, Savings, and Wants.

You can find 50/20/30 rule calculators online to play with too if that makes it easier for you.

This one at Nerd Wallet is a good one, but you can set up an MS spreadsheet to work for you too.

Basically, what this budget system entails is that list down your take-home income which should be spent on necessities, 20% should be put into savings or towards paying off debt, and the remaining 30 percent is for your wants.

Your wants are basically anything you want to spend your money on such as make-up, buying a fancy phone, or even simply clothing.

And your needs include everything you need to survive such as housing, food, transportation, basic utilities, insurance, childcare, and minimum loan payments.

Savings includes investing money in a savings account, stocks, bonds, growing your emergency fund, or paying down debt.

If you want a more traditional budget to plan it all out, you can use my free budget planner!

You can also use budget planners for beginners like these ones to help you better define your budget or free monthly budget templates like these so you can budget your money right away.

Whatever you use, make sure you stick to your budget if you really want things to work out financially.

So after all of that, which one is better?

Spending Plan vs Budget

Personally, I would do a spending planner as it is more logical for me.

Spending plans are useful because they focus on what you have left after meeting your basic needs to improve your life or reach a goal that you have set.

Budgets are great for people who have moved past living month to month and can now enjoy playing with their money more.

But also, it’s just a different mindset, so whether you use a spending plan or a budget doesn’t matter.

Choose one or the other.

The point is to make it work for your financial needs right now.

Spending Plan Template

Here is a copy of a spending plan printable you can use to organize your money.

Go ahead and grab your very own FREE spending tracker right here.

What are the benefits of a spending plan?

What are the benefits of a spending plan?

As I mentioned earlier, a spending plan is really just a plan you create to help you meet your monthly expenses. Whatever is left you can spend it as you wish.

I would definitely suggest that you save the leftover money so you can prepare for an emergency. But other than that, a spending plan…

- Will help you live within your income

- Will give you better control of your money instead of the money controlling you

- Will help you see where you are over-spending

- Will also help you limit spending on things you don’t need

A monthly spending plan will definitely help you better organize your finances so you are less stressed!

Which one will you stick to? A Spending Plan or A Strict Budget?

Whatever you choose taking the first step for learning how to organize finances is no easy task, but I am so glad that you took the necessary steps to get started.

For more finance tips please sign up for our 30 days to more money challenge right here.

Read next:

- How to manage your personal finances as an entrepreneur

- 10 Powerful Financial Advice for Women For Improving Finances

If you enjoyed our blog we would like to have you join our email list and receive weekly money-making tips, you can join now! Don’t forget to join our Private Facebook page. The page is created to share your work, pitch your services, and learn from other experienced bloggers!

If you enjoyed our blog we would like to have you join our email list and receive weekly money-making tips, you can join now! Don’t forget to join our Private Facebook page. The page is created to share your work, pitch your services, and learn from other experienced bloggers!

***We would like to note that this post and most posts on our blog may contain affiliate links. This means that if you purchase something that has an affiliate link, we will get a commission from it. Not all items recommended on our site are affiliate links. We only recommend items that we have used and tried. These items have brought us much success and we highly recommend them to you in order to be successful. Thank you for your trust!

Thanks for sharing the nice blog. Each line is filled with valuable meaning. Are you facing trouble in solving your Assignment? Now you have landed in the right place. We are the best help assignment Australia So that students solved their difficult Assignment easily. Also, our Content writers provide plag-free and error-free content.

Very great post.

I just stumbled upon your blog and wanted to say that I have truly loved browsing your blog posts.

In any case I will be subscribing on your feed and I hope you write again very soon!

Feel free to visit my website ✅

온라인 카지노 게임

스포츠 토토 일정

토토 라이브 스코어

온라인 카지노 사이트

안전 카지노 사이트

https://www.j9korea.com

Well, amazing post i really love your blog posts thanks for sharing.

Nice post. Thanks for sharing with us. For help with any type of assessment, you can email me and we can arrange a time that works for you. Our ACS Assessment Help service is designed to help you reach your assessment goals, whether you’re in the middle of a course or about to take a major assessment test. 100 percent plagiarism free.

assessment help

You are so charming when writing articles I can feel it. It’s really unbelievable. I didn’t expect to receive any new news from here.

Excellent blog. Thank you for sharing this information through this blog. Our experts are here to assist with, Dissertation Help Writing Services help in the UK. We have a professional dissertation help expert. If you are facing problems in contact us

I’m writing on this topic these days, majorsite, but I have stopped writing because there is no reference material. Then I accidentally found your article. I can refer to a variety of materials, so I think the work I was preparing will work! Thank you for your efforts.

Wonderful! points such an artistic post, thankfulness you for sharing this post.

B3 BOMBER JACKET

LEATHER SHIRT MENS

WOMEN LEATHER BOMBER JACKETS

SHEEPSKIN JACKET WOMENS

this blog is a very informative blog. i am interested thank you for share. keep sharing.

Thanks for providing such a wonderful post!

Men Leather Long Coats

Harley Davidson Jacket

Shearling Jackets Women

Great! this post grabs wonderful information.

Thank you for sharing this article. I found it very inspiring and I’m now going to promote our Order Prescription Online site. These tips are invaluable. Again, thank you.

Great information. Thanks for providing us such a useful information. Keep up the good work and continue providing us more quality information from time to time.

BUY PAX ERA PODS – ROSIN

https://pyramidpens.shop/product/pax-era-pods-rosin/

ARE YOU LOOKING FOR WHERE TO BUY PAX ERA PODS – ROSIN

ORDER PAX ERA PODS – ROSIN ONLINE

PURCHASE PAX ERA PODS – ROSIN HERE

What Pods Are Compatible With PAX Era?

PAX’s SimpleClick pods are designed specifically for use with the PAX Era. These pods come pre-filled with concentrated cannabis oil from one of the brand’s 50+ extract partners.

Do PAX pods leave a smell?

The answer is no. Although vaping your material will likely result in a subtle scent, it will quickly dissipate after your session. PAX Era Pods Rosin Cannabis Oil in Colorado

https://pyramidpens.shop/product-category/pax-pods/

Is vaping worse than smoking?

1: Vaping is less harmful than smoking, but it’s still not safe. E-cigarettes heat nicotine (extracted from tobacco), flavorings and other chemicals to create an aerosol that you inhale. Regular tobacco cigarettes contain 7,000 chemicals, many of which are toxic.

https://pyramidpens.shop/product/buy-mexicana/

https://pyramidpens.shop/product/buy-penis-envy-cubensis/

https://pyramidpens.shop/product/buy-nn-dmt/

https://pyramidpens.shop/product/buy-delta-8-thc-gummies/

https://pyramidpens.shop/product/everest-delta-8-oil/

https://pyramidpens.shop/product/buy-delta-8-vape-thc-cartridge/

https://pyramidpens.shop/product-tag/10x-delta-8-vape-cartridge-900mg/

https://pyramidpens.shop/product-tag/10x-delta-8/

https://pyramidpens.shop/product-tag/10x-delta-8-thc/

https://pyramidpens.shop/product/mexican-xp-magic-mushroom/

https://pyramidpens.shop/product/buy-delta-8-oil/

https://pyramidpens.shop/product/live-resin-concentrates/

https://pyramidpens.shop/product/pax-era-pods-budder/

https://pyramidpens.shop/product/pax-era-pro-battery/

https://pyramidpens.shop/product/buy-delta-8-vape-cartridge/

https://pyramidpens.shop/product/budder-concentrates/

https://pyramidpens.shop/product/pax-era-pods-rosin/

https://pyramidpens.shop/product/pax-era-pods-for-sale/

https://pyramidpens.shop/product/pax-era-life/

Pug Puppies for Sale Near Me

pugs puppies for sale

teacup pugs for sale

pug puppies for sale by owner

pug puppies ohio

PUG PUPPY FOR SALE NEAR ME

PUG PUPPIES FOR SALE

pug puppies for sale in kentucky

Pug Puppies for Sale Under $500 Near Me

pug puppies for sale in texas

pug puppies for sale $200

pugs for sale near me under $500

pugs for sale under $400 near me

pugs for sale near me

puppies for sale near me under $500

pug puppies for sale under $1,000 near me

pug for sale

pug puppies for sale under $300

Brindle Pug

Pitbull Pug Mix

Pugs for sale cheap

Cheap pug

affordable pug puppies for sale near me

black pugs for sale near me

White Pugs for sale

pug dog for sale

free pug puppies

pug puppies for sale in my area

mn pug breeders

pug puppies indiana

pugs for sale michigan

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

USA

PUG PUPPY ADOPTION

Pug puppies for sale

Pug puppies for sale near me

Pug puppies near me

Pug Puppies for Sale Under $500 Near Me

Cute Pug Puppies

Black pug puppies

Black pug puppies for sale

pug puppies for adoption

black pug puppies for sale near me

chihuahua pug mix puppies

how much is a pug puppy

teacup pug puppies

baby pug puppies

baby pug puppies for sale

pictures of pug puppies

pug puppies for sale in Ohio

pug puppies price

pug mix puppies

teacup pug puppies for sale

best food for pug puppy

newborn pug puppies

pug puppies craigslist

pug puppies for sale craigslist

adorable pug puppies

how much does a pug puppy cost

Pitbull pug mix puppies

pug pit mix puppy

pug puppies for sale $200

pug puppies for sale in NJ

Pug puppies for sale in Wisconsin

pug puppy cost

pug puppy food

royal canin pug puppy

royal canin pug puppy food

fawn pug puppy

pug puppies for sale florida

pug puppies for sale in Indiana

pug puppies for sale in KY

pug puppies for sale in NC

pug dog puppy

AKC Registered Pug Puppies For sale

cheap pug puppies for sale near me

cheap pug puppies for sale in California

cheap pug puppies for sale in nj

Black Pug Puppies for sale

pugs puppies for sale

Thank you so much for this post, I was Impressed by your post a lot I am also here to advertise our complete my assignment website. I am so using these tips. Thank you again.

Hey! My Name Is Sunny Handa Md And I’m Working as A Doctor. I Love Being A Doctor. It Is The Most Fulfilling Job I’ve Ever Had. I Have Been Providing How To Prepare For A Upcoming Recession by Sunny Handa Md To People.

Nice article thanks for sharing this useful information with us

Thank you so much admin for uploading such amazing content with us your blog is really helpful for me.

Excellent article. Very interesting to read. I really love to read such a nice article. Thanks! keep rocking. CreativeTDesign

This is an amazing post, and no doubt interesting, as well as you discussed the history and concept of pascal’s triangle.Ultimo Fashions UK

Pug pups for sale are utterly gorgeous, affectionate, and intelligent. Excellent pedigrees, gorgeous coats, finely formed ears, a tight, curled tail, outstanding faces, and a superb conformation like their parents are all present in these puppies. The parents are both in wonderful health and are kind and devoted family members. They will arrive fully registered with the AKC, with pedigree papers, and with a one-year health guarantee.

Pug Puppies for Sale Near Me

pugs puppies for sale

teacup pugs for sale

pug puppies for sale by owner

pug puppies ohio

PUG PUPPY FOR SALE NEAR ME

PUG PUPPIES FOR SALE

pug puppies for sale in kentucky

Pug Puppies for Sale Under $500 Near Me

pug puppies for sale in texas

pug puppies for sale $200

pugs for sale near me under $500

pugs for sale under $400 near me

pugs for sale near me

puppies for sale near me under $500

pug puppies for sale under $1,000 near me

pug for sale

pug puppies for sale under $300

Brindle Pug

Pitbull Pug Mix

Pugs for sale cheap

Cheap pug

affordable pug puppies for sale near me

black pugs for sale near me

White Pugs for sale

pug dog for sale

free pug puppies

pug puppies for sale in my area

mn pug breeders

pug puppies indiana

pugs for sale michigan

PUG PUPPY ADOPTION

Pug puppies for sale

Pug puppies for sale near me

Pug puppies near me

Pug Puppies for Sale Under $500 Near Me

Cute Pug Puppies

Black pug puppies

Black pug puppies for sale

pug puppies for adoption

black pug puppies for sale near me

chihuahua pug mix puppies

how much is a pug puppy

teacup pug puppies

baby pug puppies

pictures of pug puppies

pug puppies for sale in Ohio

pug puppies price

pug mix puppies

teacup pug puppies for sale

best food for pug puppy

newborn pug puppies

pug puppies craigslist

pug puppies for sale craigslist

adorable pug puppies

how much does a pug puppy cost

Pitbull pug mix puppies

pug pit mix puppy

pug puppies for sale $200

pug puppies for sale in NJ

Pug puppies for sale in Wisconsin

pug puppy cost

pug puppy food

royal canin pug puppy

royal canin pug puppy food

fawn pug puppy

pug puppies for sale florida

pug puppies for sale in Indiana

pug puppies for sale in KY

pug puppies for sale in NC

pug dog puppy

AKC Registered Pug Puppies For sale

cheap pug puppies for sale near me

cheap pug puppies for sale in California

cheap pug puppies for sale in nj

Black Pug Puppies for sale

pugs puppies for sale

Do you know what we get excited about at any festival? There are several possibilities. But one of the most exciting aspects is that we get to wear some fantastic outfits. And, of course, on Halloween, we will undoubtedly dress up in the most unusual costumes rather than our usual ones. Isn’t Halloween just around the corner a piece of excellent news for all of you? What is more good to hear is that we have compiled a list of the Top 5 Halloween Costumes 2022. Yes, as always, we are here with our whole selection and some top picks on the list. So, for all of your Halloween outfit needs, shop under one roof for all of your loved ones and for yourself.

.

Testing

Payroll Services Payroll is not just about paying your people and you didn’t get into the business to manage paperwork and keep track of payroll services legislations.

This blog is very impressive and informative thanks for this blog. We are Tafe Assignment Help

provider for student in Australia. our experts are 24/7 available.

Hope more people will read this article keep up the good work This Article is Awesome. It’s help me a lot. Please keep up your good work. We are always with you and Waiting for your new interesting articles.

Thanks for sharing such information with us. It was too useful and productive. The Map of Tiny Perfect Things Corinthian Trench Coat . Please keep posting such great work.

Why couldn’t I have the same or similar opinions as you? T^T I hope you also visit my blog and give us a good opinion. totosite

Thank you very much for your good information womens suede jackets

Awesome post. I’m a normal visitor of your web site and appreciate you taking the time to maintain the excellent site dissertation writers helpMetrikmoto T-shirt

https://www.gamja888.com/ – 바카라사이트,카지노사이트,카지노게임사이트,온라인바카라,온라인카지노,Gamja888

https://gamja888.com/ – 퀸즈슬롯

https://gamja888.com/ – 맥스카지노

https://gamja888.com/ – 비바카지노

https://gamja888.com/ – 카지노주소

https://gamja888.com/ – 바카라추천

https://gamja888.com/ – 온라인바카라게임

https://gamja888.com/ – 안전한 바카라사이트

https://gamja888.com/ – 바카라

https://gamja888.com/ – 카지노

https://gamja888.com/ – 퀸즈슬롯 카지노

https://gamja888.com/ – 바카라게임사이트

https://gamja888.com/onlinebaccarat/ – 온라인바카라

https://gamja888.com/millionclubcasino/ – 밀리언클럽카지노

https://gamja888.com/safecasinosite/ – 안전카지노사이트

https://gamja888.com/baccaratsiterecommendation/ – 바카라사이트추천

https://gamja888.com/ourcasino/ – 우리카지노계열

https://gamja888.com/slotmachine777/ – 슬롯머신777

https://gamja888.com/royalcasinosite/ – 로얄카지노사이트

https://gamja888.com/crazyslot/ – 크레이지슬롯

https://gamja888.com/onlineblackjack/ – 온라인블랙잭

https://gamja888.com/internetroulette/ – 인터넷룰렛

https://gamja888.com/casinoverificationsite/ – 카지노검증사이트

https://gamja888.com/safebaccaratsite/ – 안전바카라사이트

https://gamja888.com/mobilebaccarat/ – 모바일바카라

https://gamja888.com/howtowin-baccarat/ – 바카라 필승법

https://gamja888.com/meritcasino/ – 메리트카지노

https://gamja888.com/baccarat-howto/ – 바카라 노하우

youube.me

instagrme.com

youubbe.me

Instagrm.me

Instagrme.net

internetgame.me

instagrme.live

naverom.me

facebokom.me

https://www.instagrme.com/ – 바카라사이트,우리카지노,온라인바카라,카지노사이트,실시간바카라

https://instagrme.com/ – 퀸즈슬롯

https://instagrme.com/ – 바카라게임

https://instagrme.com/ – 카지노주소

https://instagrme.com/ – 온라인카지노

https://instagrme.com/ – 온라인카지노사이트

https://instagrme.com/ – 바카라게임사이트

https://instagrme.com/ – 실시간바카라사이트

https://instagrme.com/ – 바카라

https://instagrme.com/ – 카지노

https://instagrme.com/woori-casino/ – 우리카지노

https://instagrme.com/theking-casino/ – 더킹카지노

https://instagrme.com/sands-casino/ – 샌즈카지노

https://instagrme.com/yes-casino/ – 예스카지노

https://instagrme.com/coin-casino/ – 코인카지노

https://instagrme.com/thenine-casino/ – 더나인카지노

https://instagrme.com/thezone-casino/ – 더존카지노

https://instagrme.com/casino-site/ – 카지노사이트

https://instagrme.com/gold-casino/ – 골드카지노

https://instagrme.com/evolution-casino/ – 에볼루션카지노

https://instagrme.com/casino-slotgames/ – 카지노 슬롯게임

https://instagrme.com/baccarat/ – baccarat

https://instagrme.com/texas-holdem-poker/ – 텍사스 홀덤 포카

https://instagrme.com/blackjack/ – blackjack

youube.me

gamja888.com

youubbe.me

Instagrm.me

Instagrme.net

internetgame.me

instagrme.live

naverom.me

facebokom.me

https://www.youubbe.me/ – 카지노사이트,바카라사이트,슬롯사이트,온라인카지노,카지노주소

https://youubbe.me/ – 카지노검증사이트

https://youubbe.me/ – 안전한카지노사이트

https://youubbe.me/ – 슬롯카지노

https://youubbe.me/ – 바카라게임

https://youubbe.me/ – 카지노추천

https://youubbe.me/ – 비바카지노

https://youubbe.me/ – 퀸즈슬롯

https://youubbe.me/ – 카지노

https://youubbe.me/ – 바카라

https://youubbe.me/ – 안전한 바카라사이트

https://youubbe.me/ – 온라인슬롯

https://youubbe.me/casinosite/ – 카지노사이트

https://youubbe.me/baccarat/ – 바카라

https://youubbe.me/baccaratsite/ – 바카라사이트

https://youubbe.me/pharaoh-casino/ – 파라오카지노

https://youubbe.me/제왕카지노/ – 제왕카지노

https://youubbe.me/mgm카지노/ – mgm카지노

https://youubbe.me/theking-casino/ – 더킹카지노

https://youubbe.me/coin-casino/ – 코인카지노

https://youubbe.me/solaire-casino/ – 솔레어카지노

https://youubbe.me/casino-game/ – 카지노게임

https://youubbe.me/micro-gaming/ – 마이크로게이밍

https://youubbe.me/asia-gaming/ – 아시아게이밍

https://youubbe.me/taisan-gaming/ – 타이산게이밍

https://youubbe.me/oriental-game/ – 오리엔탈게임

https://youubbe.me/evolution-game/ – 에볼루션게임

https://youubbe.me/dragon-tiger/ – 드래곤타이거

https://youubbe.me/dream-gaming/ – 드림게이밍

https://youubbe.me/vivo-gaming/ – 비보게이밍

youube.me

gamja888.com

instagrme.com

Instagrm.me

Instagrme.net

internetgame.me

instagrme.live

naverom.me

facebokom.me

https://www.youube.me/ – 카지노사이트,바카라사이트,바카라게임사이트,온라인바카라,인터넷카지노

https://youube.me/ – 퀸즈슬롯

https://youube.me/ – 카지노주소

https://youube.me/ – 비바카지노

https://youube.me/ – 카지노추천

https://youube.me/ – 카지노게임

https://youube.me/ – 온라인카지노사이트

https://youube.me/ – 카지노

https://youube.me/ – 바카라

https://youube.me/ – 온라인카지노

https://youube.me/ – 카지노게임사이트

https://youube.me/sandscasinoaddress/ – 카지노검증사이트

https://youube.me/royalcasinoseries/ – 로얄카지노계열

https://youube.me/slotmachinesite/ – 슬롯머신사이트

https://youube.me/maxcasino/ – 맥스카지노

https://youube.me/baccaratgamesite/ – 바카라게임사이트

https://youube.me/casimbakorea-casino/ – 카심바코리아 카지노

https://youube.me/mobilecasino/ – 모바일카지노

https://youube.me/real-timebaccarat/ – 실시간바카라

https://youube.me/livecasino/ – 라이브카지노

https://youube.me/onlineslots/ – 온라인슬롯

https://youube.me/sandscasinoaddress/ – 바카라 이기는방법

https://youube.me/safecasinosite/ – 안전카지노사이트

https://youube.me/ourcasinosite/ – 우리카지노사이트

https://youube.me/sandscasinoaddress/ – 샌즈카지노주소

https://youube.me/baccarat-rulesofthegame/ – 바카라 게임규칙

https://youube.me/baccarat-howtoplay/ – 바카라 게임방법

gamja888.com

instagrme.com

youubbe.me

Instagrm.me

Instagrme.net

internetgame.me

instagrme.live

naverom.me

facebokom.me

Hello ! I am the one who writes posts on these topics casino online I would like to write an article based on your article. When can I ask for a review?

I’ve been troubled for several days with this topic. slotsite, But by chance looking at your post solved my problem! I will leave my blog, so when would you like to visit it?

I am very impressed with your writing casinosite I couldn’t think of this, but it’s amazing! I wrote several posts similar to this one, but please come and see!

Hello. I am here to help you find an answer to a relevant question. Click here if you want to find License in Belize for sale https://eli-deal.com/businesses-for-sale/license-in-belize/ . This is a very good and reliable company that will help you understand everything. I have been working with them for many years and i can say they are real professionals.

Hi. If I need to get a better essay right away, I always turn to this professional essay writing service https://essayusa.com . I really like the way they do their job. They have never let me down. The most important thing is that they always do it exactly right.

Your blog is very nice Wish to see much more like this. Thanks for sharing your information! I bookmark your blog because I found very good information on your Afc richmond Jacket

Your blog website provided us with useful information to execute with. Each & every recommendation of your website is awesome. Thanks a lot for talking about it. TheUSASuits

Great article! All the articles you have, they enjoy reading and learning a lot. Your article is very helpful for me. I hope you will continue to write such good articles as well. Really enjoyed reading your blog.It is highly informative and builds great interest for the readers. For the people like us your blogs helps to get ideal information and knowledge. Thanks for providing such blogs. Bape Hoodie

I hope you will continue to have similar posts to share with everyone

used tractor price

I would definitely suggest that you save the leftover money so you can prepare for an emergency. But other than that, a spending plan

Hey! This is an essential idea you have publish. i will definitely follow it. & will share the feedback after gain an advantage by follow the steps regarding plan vs budget. but first want to wind u my article of shearling coats and jackets

More regularly than not basic for the journalists and understudies as well. i will be related with you people bunches to start an bewildering web journal like this.

Charging Port Replacement

nice post. You have nicely explained the way of saving money.

That was really a great Article. Thanks for sharing information. Continue doing this.

Mahindra Tractor

Okay I must say am really impressed by this article.